risk mitigation

Administering Construction Contracts Key Insights

Administering Construction Contracts: Navigating Key Insights

Embarking on a construction project involves more than just groundbreaking and hammering; it requires effective contract administration. In the intricate dance of construction contract administration, key insights pave the way for a smooth and successful journey from conception to completion.

Understanding the Framework: The Essence of Contract Administration

At the core of construction projects lies the framework of contracts. Construction contract administration is not about mere paperwork; it’s about understanding the essence of the contractual framework. From the initial negotiation to the final handshake, each step requires a keen eye for detail and a comprehensive understanding of the contractual obligations.

The Role of Oversight: Guiding the Construction Process

Effective construction contract administration serves as the guiding force throughout the construction process. It involves oversight that ensures all parties involved adhere to the terms and conditions laid out in the contract. From project milestones to quality standards, the administrator acts as the vigilant guardian, ensuring the project stays on course.

Navigating the Contractual Landscape: Construction Contract Administration Unveiled

In the realm of construction, Construction Contract Administration stands as the beacon of insight. Their expertise in navigating the contractual landscape goes beyond conventional administration. Engaging with them ensures that your construction project is not just a series of tasks; it’s a well-guided journey through the intricacies of contractual obligations.

Effective Communication: The Keystone of Administration

Communication is the lifeline of construction contract administration. It involves not just relaying information but ensuring that all stakeholders are on the same page. From regular updates to addressing concerns, effective communication becomes the keystone that holds the administrative framework together, preventing potential issues from escalating.

Mitigating Risks: Proactive Administration in Action

In the unpredictable terrain of construction, risks are inevitable. The best construction contract administration doesn’t merely react to risks; it anticipates and mitigates them. Proactive administration involves identifying potential pitfalls, developing contingency plans, and ensuring that the project sails smoothly even in the face of unforeseen challenges.

Ensuring Compliance: Upholding Contractual Obligations

One of the pivotal roles of construction contract administration is ensuring compliance. It involves not only monitoring progress but also confirming that all parties adhere to the agreed-upon terms. Upholding contractual obligations safeguards the integrity of the project, promoting a collaborative environment where everyone is accountable.

Transparent Processes: A Window into Administration Excellence

Transparency is not just a buzzword in construction contract administration; it’s a fundamental principle. Transparent processes involve keeping all stakeholders informed about the project’s status, financial aspects, and any deviations from the original plan. This transparency not only builds trust but also allows for informed decision-making.

Documentation Mastery: Recording Project Evolution

In the meticulous dance of administration, documentation mastery is paramount. It involves recording every aspect of the project’s evolution, from contractual amendments to change orders and project milestones. Thorough documentation serves as a historical record and a valuable resource for future reference or potential disputes.

Collaborative Problem-Solving: Resolving Issues Effectively

In the complex world of construction, issues are bound to arise. What sets

Unlocking Value: Rental Property Appreciation Strategies

Unlocking Value: Rental Property Appreciation Strategies

Investing in rental properties not only provides immediate rental income but also offers the potential for property appreciation over time. Understanding the factors influencing rental property appreciation and implementing strategic measures can significantly enhance the long-term value of your investment.

Factors Influencing Rental Property Appreciation

Several factors contribute to the appreciation of rental properties. Location, economic growth, development projects, and improvements in infrastructure can positively impact property values. Additionally, the overall real estate market conditions, including supply and demand dynamics, play a crucial role in determining the appreciation potential of rental properties.

Strategic Property Upgrades and Renovations

One effective strategy for enhancing rental property appreciation is to invest in strategic upgrades and renovations. Improving the property’s curb appeal, modernizing interiors, and incorporating energy-efficient features can attract higher-quality tenants and positively influence the property’s market value over time.

Proactive Maintenance and Careful Management

Regular maintenance and attentive property management contribute to rental property appreciation. Addressing maintenance issues promptly, conducting regular inspections, and ensuring the property is well-maintained create a positive impression. A well-managed property is more likely to retain its value and appreciate over the years.

Adapting to Market Trends and Demands

Staying informed about market trends and tenant demands is crucial for maximizing rental property appreciation. Understanding what features and amenities are currently in demand allows landlords to adapt their properties to meet market expectations. This adaptability enhances the property’s attractiveness and potential for appreciation.

Long-Term Lease Agreements and Stable Tenancy

Securing long-term lease agreements with stable tenants can contribute to rental property appreciation. A consistent rental income stream and lower turnover rates positively impact the property’s overall performance. Long-term tenants who treat the property with care and respect can help maintain its condition and desirability.

Monitoring Economic Indicators

Economic indicators, such as job growth, population growth, and local economic development, directly influence rental property appreciation. Investing in areas with positive economic prospects increases the likelihood of property values appreciating over time. Regularly monitoring these indicators allows investors to make informed decisions.

Smart Financing and Mortgage Management

Optimizing financing arrangements and managing mortgages intelligently can impact the potential for rental property appreciation. Securing favorable mortgage terms, refinancing when beneficial, and exploring financing options can contribute to improved cash flow and overall property value growth.

Diversification for Risk Mitigation

Diversifying your rental property portfolio is a prudent strategy for mitigating risk and enhancing appreciation potential. Investing in properties across different locations or types can provide a buffer against market fluctuations. Diversification spreads risk and increases the likelihood of overall portfolio appreciation.

Engaging with Local Community Development

Active engagement with local community development initiatives can positively influence rental property appreciation. Supporting and participating in neighborhood improvement projects, advocating for infrastructure enhancements, and contributing to community development can foster an environment where property values are likely to appreciate.

Leveraging Professional Advice and Resources

For landlords seeking to optimize rental property appreciation, leveraging professional advice and resources is invaluable. Seeking guidance from real estate experts, financial advisors, and

Smart Strategies for Profitable Rental Property Investment

Smart Strategies for Profitable Rental Property Investment

Investing in rental properties can be a lucrative venture, but success requires careful planning, market awareness, and strategic decision-making. Whether you’re a seasoned investor or a newcomer to the real estate market, adopting smart strategies can enhance the profitability of your rental property investments.

Understanding Market Trends and Dynamics

Before diving into rental property investment, it’s crucial to understand current market trends and dynamics. Analyzing factors such as housing demand, rental prices, and economic indicators provides a foundation for informed decision-making. Regularly monitoring the market helps investors identify opportunities and potential challenges.

Location, Location, Location: Key to Investment Success

The age-old adage “location, location, location” holds true in real estate, especially in rental property investment. Choosing properties in desirable locations with good amenities, proximity to essential services, and a strong rental market increases the likelihood of attracting quality tenants and achieving better rental yields.

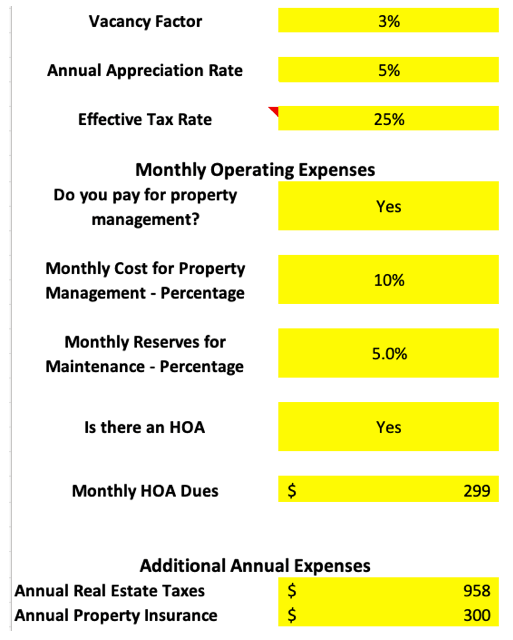

Financial Planning and Budgeting

Successful rental property investment requires careful financial planning and budgeting. Investors should consider not only the purchase price of the property but also additional costs such as maintenance, property management fees, and potential vacancies. Creating a realistic budget ensures investors are prepared for the full spectrum of expenses.

Tenant Screening and Quality Management

Ensuring a steady income stream involves thorough tenant screening and effective property management. Selecting reliable tenants who pay rent on time and maintain the property is essential. Quality property management, whether handled personally or through professional services, contributes to tenant satisfaction and property upkeep.

Adapting to Evolving Technology

Embracing technology is a key strategy in modern rental property investment. Online platforms for property searches, digital lease signings, and property management software streamline processes and enhance efficiency. Investors leveraging technology can stay competitive and provide a seamless experience for both tenants and themselves.

Tax Considerations and Incentives

Understanding tax considerations and incentives is crucial for maximizing returns on rental property investments. Investors should be aware of tax deductions related to property expenses, depreciation, and potential incentives offered by local governments to encourage property investment. Seeking advice from tax professionals ensures compliance with tax regulations.

Balancing Short-Term Gains with Long-Term Growth

While rental property investment can offer short-term gains through rental income, it’s essential to balance this with a focus on long-term growth. Property appreciation over time can significantly contribute to overall investment returns. Investors should have a clear strategy that aligns with their financial goals and timeline.

Continuous Education and Market Research

The real estate market is dynamic, and staying informed is an ongoing process. Continuous education and market research help investors adapt to changing trends, regulations, and economic conditions. Engaging in industry-related seminars, reading publications, and networking with other investors contribute to a well-informed investment approach.

Risk Mitigation Strategies

Investing always involves some level of risk, but savvy investors implement risk mitigation strategies. This includes diversifying the investment portfolio, having contingency plans for economic downturns, and staying financially resilient. Understanding the potential risks and having strategies in place helps investors navigate uncertainties.