market trends

Optimizing Investments: Rental Property Market Analysis Essentials

Optimizing Investments: Rental Property Market Analysis Essentials

Investing in rental properties requires a strategic approach that goes beyond purchasing a property. Conducting a comprehensive market analysis is a key step in optimizing your investments and ensuring long-term success. In this article, we’ll explore the essential elements of rental property market analysis and how it can contribute to making informed investment decisions.

Understanding the Local Real Estate Landscape

Before diving into the specifics of a particular property, it’s crucial to understand the broader local real estate landscape. Analyze trends in property values, rental rates, and vacancy rates in the area. A thorough understanding of the local market sets the foundation for making informed decisions about potential investments.

Assessing Rental Demand and Supply

A critical aspect of rental property market analysis is assessing the demand and supply dynamics. Evaluate the current demand for rental properties in the area and compare it with the available supply. A high demand and limited supply often indicate a favorable market for landlords, providing opportunities for competitive rental rates and occupancy.

Analyzing Economic Indicators

Consider economic indicators that may impact the rental market. Factors such as job growth, population trends, and overall economic stability can influence the demand for rental properties. Analyzing these indicators helps in predicting the potential for sustained rental income and property appreciation over time.

Evaluating Neighborhood Desirability

The desirability of the neighborhood plays a significant role in the success of a rental property. Consider factors such as proximity to amenities, safety, school quality, and public transportation. Understanding the neighborhood’s appeal helps in targeting tenants looking for a specific lifestyle, ultimately affecting the property’s marketability.

Reviewing Historical Rental Performance

Examine the historical performance of rental properties in the area. This includes rental appreciation rates, average vacancy durations, and overall return on investment. Historical data provides insights into the stability and profitability of the rental market, guiding your investment decisions based on past performance trends.

Estimating Potential Rental Income

One of the primary goals of rental property market analysis is to estimate potential rental income accurately. Consider factors such as comparable rental rates, property size, and amenities to determine a competitive yet profitable rental price. Accurate income estimates are crucial for financial planning and investment viability.

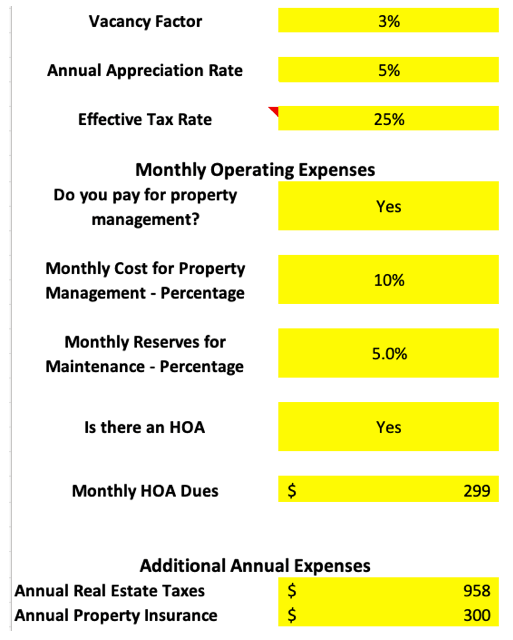

Accounting for Operating Expenses

While rental income is essential, it’s equally crucial to account for operating expenses. Consider property taxes, maintenance costs, property management fees, and any other recurring expenses. A thorough understanding of these costs ensures that your expected returns align with the overall financial health of the investment.

Projecting Return on Investment (ROI)

Calculate the projected return on investment by factoring in both rental income and operating expenses. A positive ROI indicates a financially sound investment. This projection helps investors compare different properties and make decisions based on the potential for long-term profitability.

Staying Informed About Legal and Regulatory Factors

Rental property market analysis should also consider legal and regulatory factors that may impact the investment. Stay informed about local landlord-tenant laws, zoning regulations, and any upcoming

Unlocking Value: Rental Property Appreciation Strategies

Unlocking Value: Rental Property Appreciation Strategies

Investing in rental properties not only provides immediate rental income but also offers the potential for property appreciation over time. Understanding the factors influencing rental property appreciation and implementing strategic measures can significantly enhance the long-term value of your investment.

Factors Influencing Rental Property Appreciation

Several factors contribute to the appreciation of rental properties. Location, economic growth, development projects, and improvements in infrastructure can positively impact property values. Additionally, the overall real estate market conditions, including supply and demand dynamics, play a crucial role in determining the appreciation potential of rental properties.

Strategic Property Upgrades and Renovations

One effective strategy for enhancing rental property appreciation is to invest in strategic upgrades and renovations. Improving the property’s curb appeal, modernizing interiors, and incorporating energy-efficient features can attract higher-quality tenants and positively influence the property’s market value over time.

Proactive Maintenance and Careful Management

Regular maintenance and attentive property management contribute to rental property appreciation. Addressing maintenance issues promptly, conducting regular inspections, and ensuring the property is well-maintained create a positive impression. A well-managed property is more likely to retain its value and appreciate over the years.

Adapting to Market Trends and Demands

Staying informed about market trends and tenant demands is crucial for maximizing rental property appreciation. Understanding what features and amenities are currently in demand allows landlords to adapt their properties to meet market expectations. This adaptability enhances the property’s attractiveness and potential for appreciation.

Long-Term Lease Agreements and Stable Tenancy

Securing long-term lease agreements with stable tenants can contribute to rental property appreciation. A consistent rental income stream and lower turnover rates positively impact the property’s overall performance. Long-term tenants who treat the property with care and respect can help maintain its condition and desirability.

Monitoring Economic Indicators

Economic indicators, such as job growth, population growth, and local economic development, directly influence rental property appreciation. Investing in areas with positive economic prospects increases the likelihood of property values appreciating over time. Regularly monitoring these indicators allows investors to make informed decisions.

Smart Financing and Mortgage Management

Optimizing financing arrangements and managing mortgages intelligently can impact the potential for rental property appreciation. Securing favorable mortgage terms, refinancing when beneficial, and exploring financing options can contribute to improved cash flow and overall property value growth.

Diversification for Risk Mitigation

Diversifying your rental property portfolio is a prudent strategy for mitigating risk and enhancing appreciation potential. Investing in properties across different locations or types can provide a buffer against market fluctuations. Diversification spreads risk and increases the likelihood of overall portfolio appreciation.

Engaging with Local Community Development

Active engagement with local community development initiatives can positively influence rental property appreciation. Supporting and participating in neighborhood improvement projects, advocating for infrastructure enhancements, and contributing to community development can foster an environment where property values are likely to appreciate.

Leveraging Professional Advice and Resources

For landlords seeking to optimize rental property appreciation, leveraging professional advice and resources is invaluable. Seeking guidance from real estate experts, financial advisors, and

Thriving Trends: Dynamics of the Rental Market Today

Navigating the Landscape: Insights into the Thriving Rental Market Today

In the dynamic realm of real estate, the rental market stands as a vibrant and ever-evolving entity. As prospective tenants and landlords seek to understand the trends and shifts within this market, it becomes imperative to delve into the factors shaping its dynamics.

Market Trends: A Tapestry of Change

The rental market is not stagnant; it’s a tapestry woven with changing trends. From shifts in preferred locations to adjustments in rental prices, staying informed about these trends empowers both tenants and landlords. The ability to adapt to the evolving landscape is crucial for making informed decisions.

Technology’s Impact: Digital Transformation

In the contemporary rental market, technology plays a pivotal role in shaping its landscape. Online platforms and digital tools have streamlined the rental process, making it more accessible and efficient for both landlords and tenants. The integration of technology has ushered in a new era of convenience and transparency.

Remote Work Influences: Redefining Location Priorities

The rise of remote work has significantly influenced the rental market, redefining the priorities of both tenants and landlords. Proximity to city centers may no longer be the sole determinant; individuals now seek locations that align with their lifestyle and offer a balance between work and leisure.

Affordability Challenges: Balancing Budgets

While the rental market thrives, affordability remains a critical concern for many. Balancing the desire for desirable locations and modern amenities with budget constraints requires a strategic approach. Navigating this challenge necessitates exploring diverse neighborhoods and considering emerging areas with potential.

Demand for Sustainable Living: Eco-Conscious Choices

A notable trend within the rental market is the increasing demand for sustainable and eco-conscious living spaces. Tenants are now more inclined to choose properties that incorporate green features, energy efficiency, and eco-friendly practices. Landlords who embrace sustainability trends may find their properties more appealing to a broader audience.

Flexibility in Lease Terms: Meeting Changing Lifestyles

The traditional approach to lease terms is witnessing a shift, with an increasing emphasis on flexibility. Short-term leases, month-to-month agreements, and provisions for remote work considerations are becoming more prevalent. This flexibility caters to the evolving lifestyles and preferences of tenants in the modern era.

Supply and Demand Dynamics: Striking a Balance

Understanding the delicate balance between supply and demand is essential for both landlords and tenants. In high-demand areas, tenants may face fierce competition, necessitating swift decision-making. On the other hand, landlords in less saturated markets may need to strategically market their properties to attract tenants.

Urban and Suburban Choices: Lifestyle Preferences

The choice between urban and suburban living continues to be a defining factor in the rental market. Urban areas may offer proximity to amenities and a vibrant lifestyle, while suburban locations provide tranquility and more space. Navigating these choices requires tenants to align their decisions with personal lifestyle preferences.

Looking Ahead: Opportunities and Challenges

As we navigate the thriving rental market today, it’s essential to look ahead and anticipate both opportunities and challenges. Market dynamics may continue to

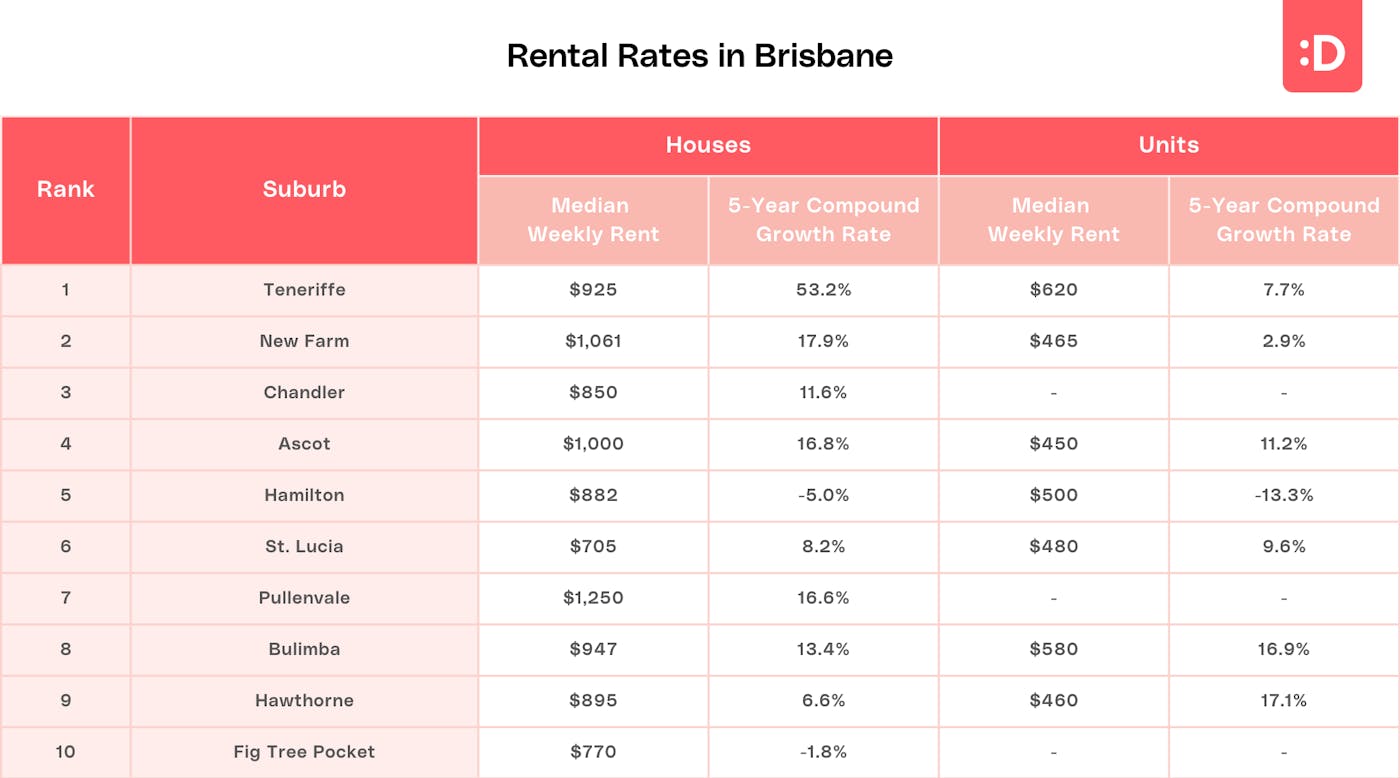

Navigating Rental Rates: Finding Your Affordable Home

Decoding the Landscape: Navigating Rental Rates for Your Ideal Home

Embarking on the journey of finding a new home involves understanding the intricacies of rental rates. From budget considerations to market trends, navigating rental rates is a crucial aspect of securing an affordable and comfortable living space.

Understanding the Factors: What Shapes Rental Rates

Rental rates are influenced by a myriad of factors. Location, property size, amenities, and local market conditions all contribute to the determination of rental rates. Understanding these factors is the first step in decoding the landscape of rental rates and making informed decisions.

Location Matters: Impact on Affordability

The geographical location of a property plays a significant role in shaping rental rates. Properties in prime locations or those close to essential services and amenities often come with higher rental costs. Balancing location preferences with budget considerations is essential for finding an affordable home that meets your needs.

Property Size and Amenities: Tailoring Your Budget

The size of the property and the amenities it offers are key contributors to rental rates. Larger living spaces or properties with modern amenities may come with higher costs. Assessing your space requirements and prioritizing essential amenities can help tailor your budget and identify properties that align with your lifestyle.

Market Trends: Adapting to Fluctuations

The rental market is dynamic, subject to fluctuations based on supply and demand. Understanding current market trends allows renters to adapt to changes in rental rates. Exploring the market and staying informed about trends can provide valuable insights into the affordability of different neighborhoods and property types.

Budget Considerations: Setting Realistic Limits

Establishing a budget is a fundamental step in navigating rental rates. It involves assessing your income, considering other monthly expenses, and setting realistic limits for housing costs. Having a clear budget in mind helps narrow down the options and ensures that you focus on properties within your financial means.

Negotiation Strategies: Seeking Favorable Terms

Negotiating rental rates is a common practice that can benefit both landlords and tenants. Renters can explore negotiation strategies, such as committing to longer lease terms or offering prompt payment, to secure more favorable rental rates. Effective communication is key to finding a mutually beneficial agreement.

Hidden Gems: Exploring Up-and-Coming Areas

While established neighborhoods may come with higher rental rates, exploring up-and-coming areas can reveal hidden gems with more affordable options. Emerging neighborhoods often offer a balance between affordability and the potential for increased property value over time. Being open to exploring new areas can broaden your housing options.

Online Platforms: Streamlining the Search

In the digital age, online platforms dedicated to real estate play a vital role in streamlining the search for affordable rentals. These platforms allow users to filter search results based on budget constraints, preferred locations, and desired amenities. Utilizing online tools can save time and help identify properties that fit within your budget.

Planning for the Future: Long-Term Affordability

Consideration for long-term affordability is crucial when navigating rental rates. While securing an affordable rental is essential, it’s

Optimal Rental Property Location: A Key to Successful Investment

The Significance of Rental Property Location in Real Estate Investment

Choosing the right location for your rental property is a critical factor that can significantly impact the success of your real estate investment. From property value appreciation to tenant demand, the location plays a pivotal role in determining the overall profitability of your investment.

Proximity to Amenities and Services

One key aspect to consider when selecting a rental property location is its proximity to amenities and essential services. Properties situated near schools, shopping centers, public transportation, and healthcare facilities tend to attract a larger pool of potential tenants. Convenience is a major selling point for renters, making such locations highly desirable.

Neighborhood Safety and Security

Safety is a top priority for tenants, and the neighborhood’s safety profile directly influences the attractiveness of a rental property. Research crime rates, police presence, and community safety initiatives in the area. A secure neighborhood not only provides peace of mind for tenants but also contributes to the long-term stability of your investment.

Economic Growth and Employment Opportunities

Consider the economic health and growth potential of the location. Areas with strong job markets and diverse employment opportunities are likely to experience sustained demand for rental properties. Economic stability contributes to tenant retention and property value appreciation, making it an essential factor for long-term investment success.

Market Trends and Property Values

Stay informed about current market trends and property values in the chosen location. Analyzing the historical performance and future projections can help you make informed decisions. A location with a track record of property value appreciation suggests a favorable investment climate.

Demographic Considerations

Understanding the demographics of the area is crucial for targeting the right tenant demographic. Different locations attract different types of residents, whether it be families, students, or young professionals. Tailoring your property to the preferences and needs of the local demographic can enhance your property’s appeal.

Local Regulations and Zoning Laws

Be aware of local regulations and zoning laws governing rental properties in the chosen location. Compliance with these regulations is essential to avoid legal issues and potential liabilities. Familiarize yourself with the rental policies, property taxes, and any restrictions that may impact your investment.

Environmental Factors and Sustainability

Increasingly, tenants are becoming conscious of environmental factors and sustainability. Consider the eco-friendliness of the location, such as access to public transportation, green spaces, and energy-efficient infrastructure. Properties in environmentally friendly locations may have a competitive edge in the rental market.

Rental Property Location: A Strategic Investment Decision

Choosing the right rental property location is a strategic decision that requires thorough research and analysis. It’s not just about the physical aspects of the property but also about the surrounding environment and its impact on the property’s performance.

Rental property location is a crucial element in the success of your real estate investment. Walenshipnig Ltd provides valuable insights into prime locations, helping you make informed decisions. With our expertise, you can navigate the real estate market confidently and maximize the returns on your rental

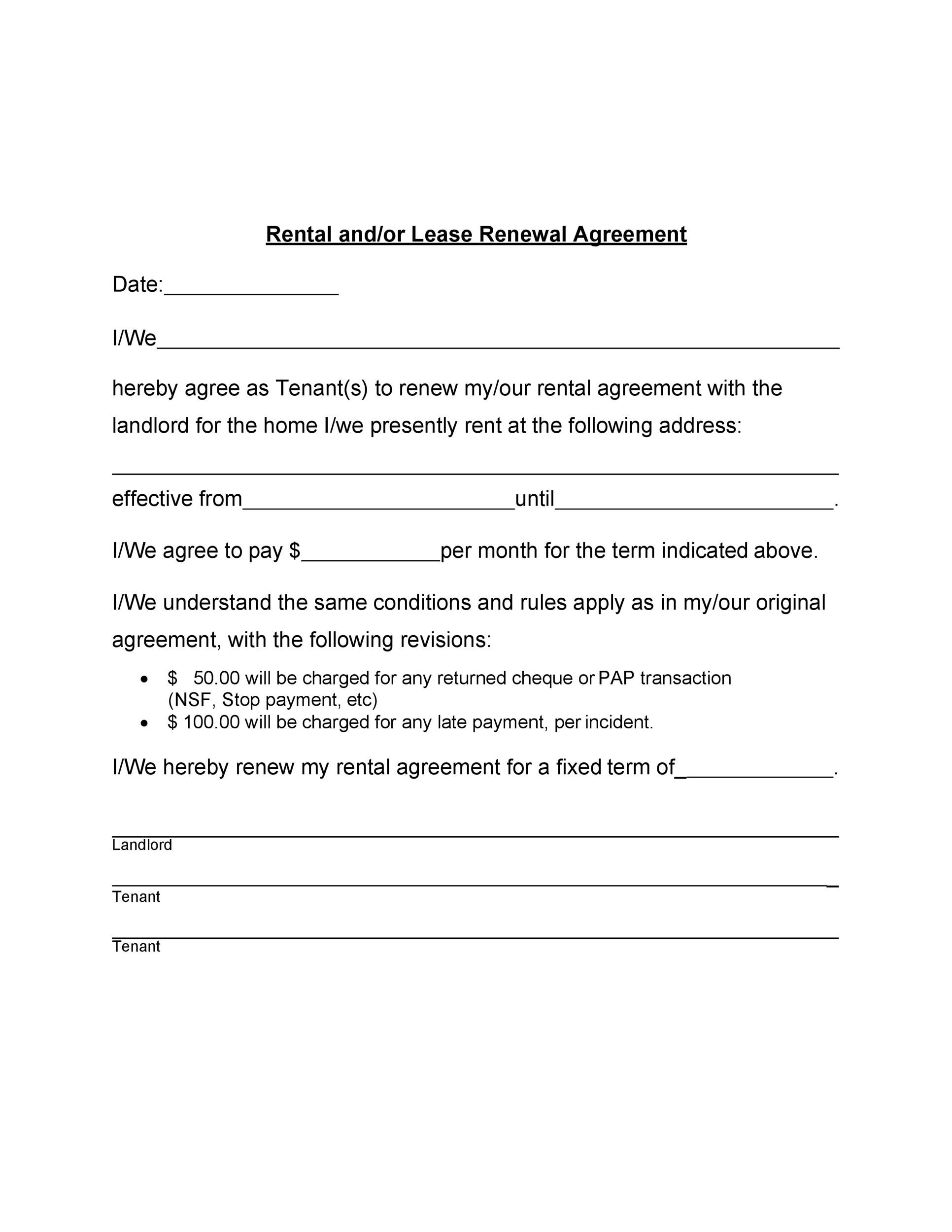

Navigating Lease Renewal Deadlines: Essential Guidelines

Understanding the Significance of Lease Renewal Deadlines

Lease renewal deadlines are a crucial aspect of the rental process, impacting both landlords and tenants. This guide aims to shed light on the importance of these deadlines and provide essential guidelines for navigating this phase successfully.

The Impact on Landlords and Tenants

Lease renewal deadlines play a pivotal role in the lives of both landlords and tenants. For landlords, it ensures a steady income stream and the opportunity to maintain a positive relationship with responsible tenants. Tenants, on the other hand, face decisions about whether to stay or explore other housing options.

Setting Clear Expectations in Lease Agreements

One of the key aspects of managing lease renewal deadlines is establishing clear expectations in the initial lease agreement. Clearly outline the process and timeframe for lease renewals to avoid confusion and ensure both parties are on the same page. This proactive approach sets the stage for a smoother renewal process.

Early Communication Benefits Both Parties

Effective communication is the cornerstone of successful lease renewals. Landlords and tenants should engage in open and transparent communication well before the actual deadline approaches. This allows for discussions about potential changes in terms, rental adjustments, or any concerns either party may have.

Offering Incentives for Timely Renewals

To encourage timely lease renewals, landlords may consider offering incentives to tenants. This could include a modest rent discount, upgraded amenities, or other perks that demonstrate appreciation for the tenant’s commitment to renewing the lease. Such incentives can contribute to a positive landlord-tenant relationship.

The Consequences of Missing Deadlines

Understanding the consequences of missing lease renewal deadlines is essential. For tenants, failing to initiate the renewal process in a timely manner may result in the loss of the rental unit to another interested party. Landlords may face challenges in finding a new tenant quickly, potentially leading to income gaps.

Automated Reminders and Technology Solutions

In the digital age, leveraging technology can streamline the lease renewal process. Landlords can utilize automated reminders to alert tenants about upcoming deadlines, ensuring they have ample time to make decisions. Technology solutions also provide a convenient platform for document exchange and communication.

Legal Implications and Compliance

Lease renewal deadlines often have legal implications. It’s crucial for both landlords and tenants to be aware of local regulations regarding notice periods and renewal procedures. Failing to adhere to these legal requirements may lead to disputes or even legal consequences. Seeking legal advice when needed is a wise approach.

Considering Market Trends and Rental Values

Another factor to consider during the lease renewal process is the current market trends and rental values. Landlords may need to reassess rental rates based on market conditions, while tenants should be aware of their bargaining power. Researching the local real estate market can provide valuable insights during negotiations.

Conclusion: A Balanced Approach to Lease Renewal Deadlines

In conclusion, navigating lease renewal deadlines requires a balanced approach from both landlords and tenants. Clear communication, early engagement, and an understanding of legal obligations are