Tenant screening

Streamlined Rental Application: Your Key to Hassle-Free Housing

Navigating the Streamlined Rental Application Process

The rental application process is a crucial step for both landlords and tenants, shaping the foundation of a successful rental agreement. Let’s delve into the intricacies of a streamlined rental application and how it can pave the way for hassle-free housing.

Understanding the Importance of a Smooth Application Process

A smooth and efficient rental application process benefits both landlords and prospective tenants. For landlords, it ensures a comprehensive assessment of potential tenants, leading to informed decisions. Tenants, on the other hand, appreciate a straightforward application process that expedites the path to securing their desired living space.

Preparing Necessary Documentation

Before diving into the application process, tenants should gather the necessary documentation. This typically includes proof of income, rental history, references, and a completed application form. Having these documents ready streamlines the application, presenting prospective tenants as organized and responsible individuals.

Completing the Application Form

The application form serves as a snapshot of a tenant’s background and financial standing. Prospective tenants should ensure they provide accurate and complete information. Transparency is key during this step to build trust with landlords and simplify the evaluation process.

Tenant Screening and Background Checks

Landlords often conduct tenant screenings and background checks as part of the application process. This step ensures a thorough assessment of a tenant’s rental history, creditworthiness, and criminal background. For tenants, maintaining a positive rental history and financial transparency enhances their chances of approval.

Prompt Communication between Landlords and Tenants

Effective communication is pivotal during the application process. Landlords should promptly respond to tenant inquiries, providing clear guidelines and expectations. Likewise, tenants should communicate any concerns or questions to ensure a transparent and collaborative process.

Applying Technology for Efficiency

Embracing technology can significantly streamline the rental application process. Online application forms, electronic document submissions, and virtual tours are examples of technological advancements that enhance efficiency for both landlords and tenants. Utilizing these tools simplifies the overall process and expedites decision-making.

Ensuring Fair Housing Practices

Landlords must adhere to fair housing practices during the application process. Discrimination based on race, gender, religion, or other protected characteristics is prohibited. Ensuring a fair and unbiased evaluation of all applicants promotes a diverse and inclusive rental community.

Reviewing Lease Terms and Conditions

Once the application is approved, tenants should carefully review the lease terms and conditions. Understanding the rental agreement in detail is crucial to prevent misunderstandings later on. Landlords should also ensure that tenants are well-informed about their rights and responsibilities.

Securing the Rental Space

Upon successful completion of the application process and lease review, tenants can secure the rental space by signing the lease agreement and paying any required deposits or fees. This final step solidifies the commitment from both parties and marks the beginning of the tenant-landlord relationship.

Exploring Streamlined Rental Applications at Walenshipnigltd.com

For those seeking streamlined rental application processes and a range of housing options, Walenshipnigltd.com offers a seamless experience. Click here to explore efficient rental applications and find your ideal living space with

Smooth Transition: Lease Transfer Requirements Unveiled

Navigating the Process: Unveiling Lease Transfer Requirements

Lease transfer requirements can seem intricate, but understanding the process is crucial for both landlords and tenants. In this guide, we’ll explore the key steps and requirements involved in lease transfers, ensuring a smooth transition for all parties.

Initiating the Transfer: Tenant Responsibilities

The process of lease transfer typically begins with the tenant expressing their intention to transfer the lease to another party. Tenants should check their lease agreement for specific clauses related to transfers and understand any restrictions or conditions. Initiating the transfer often requires formal communication with the landlord, outlining the reasons for the transfer and providing details about the prospective new tenant.

Landlord Approval: Crucial Step in the Process

One of the primary lease transfer requirements is obtaining landlord approval. Landlords typically have the right to approve or deny a lease transfer based on various factors. These may include the financial stability of the new tenant, their rental history, and their ability to meet the terms of the existing lease. It’s essential for tenants to seek landlord approval before proceeding with the transfer.

Documentation and Paperwork: Organizing Essentials

Lease transfer involves significant documentation and paperwork. Tenants and landlords need to ensure that all necessary documents are organized and completed accurately. This may include a formal request for lease transfer, a lease transfer agreement, and any additional forms required by local regulations. Thorough and organized documentation streamlines the process and reduces the likelihood of misunderstandings.

Financial Responsibilities: Clarifying Obligations

Understanding the financial obligations associated with lease transfer is vital. In many cases, tenants remain responsible for the lease until the transfer is officially approved and completed. Clear communication about rent payments, security deposits, and any fees related to the transfer ensures that all parties are aware of their financial responsibilities throughout the process.

Tenant Screening: Evaluating the New Tenant

As part of the lease transfer requirements, landlords often conduct a screening process for the prospective new tenant. This may involve a credit check, rental history verification, and possibly employment verification. The goal is to ensure that the new tenant is financially stable and meets the criteria set forth in the original lease agreement.

Updating Lease Agreement: Reflecting Changes

Once landlord approval is obtained and all necessary documentation is in order, the lease agreement must be updated to reflect the changes. This may involve drafting a new lease agreement or an amendment that clearly outlines the transfer of the lease from the original tenant to the new tenant. Updating the lease agreement ensures legal clarity and protects the rights of all parties involved.

Property Inspection: Ensuring Compliance

Some lease transfer requirements may include a property inspection. This step is often conducted to ensure that the property is in good condition before the transfer takes place. Both the outgoing tenant and the incoming tenant may be involved in the inspection process to document the state of the property and address any necessary repairs or maintenance.

Notifying Utility Companies: Transferring Services

Tenants involved in

Screening Tenants: Mastering Rental Background Checks

Navigating the Tenant Landscape: The Art of Rental Background Checks

Securing reliable and responsible tenants is a paramount concern for landlords. The key to achieving this lies in conducting thorough rental background checks. These checks provide valuable insights into a prospective tenant’s history, financial stability, and overall suitability for a rental property. In this article, we explore the nuances of rental background checks, from their importance to the steps involved in the screening process.

Understanding the Significance: Why Rental Background Checks Matter

Rental background checks serve as a critical tool for landlords to assess the risk associated with potential tenants. By delving into a tenant’s past, landlords can gauge their financial responsibility, rental history, and potential red flags. This comprehensive evaluation enables landlords to make informed decisions, minimizing the likelihood of problematic tenancies and fostering a positive living environment for all residents.

Components of a Comprehensive Check: What to Look For

A comprehensive rental background check encompasses various components. Key aspects include a tenant’s credit history, rental payment history, criminal background, employment and income verification, and references from previous landlords. Each of these elements contributes to the overall picture, helping landlords assess a tenant’s ability to meet financial obligations and maintain a good rental record.

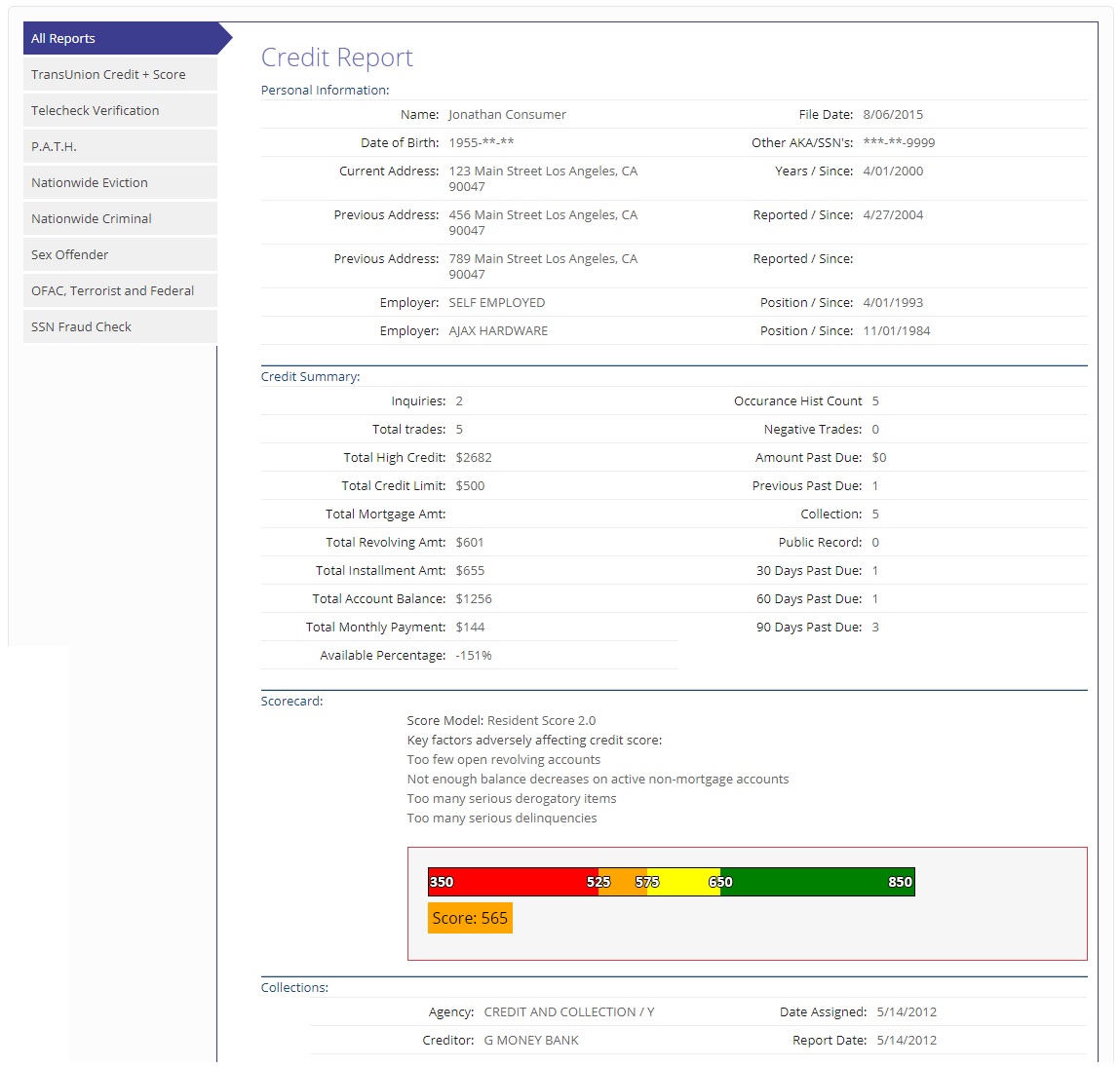

Credit History: Unveiling Financial Responsibility

One of the crucial elements in a background check is a tenant’s credit history. This reveals their financial responsibility and how well they manage debts and financial commitments. Landlords typically look for a satisfactory credit score, indicating a tenant’s ability to meet rent payments and other financial obligations consistently.

Rental Payment History: A Window into Tenant Reliability

Examining a tenant’s rental payment history provides insights into their reliability as renters. Landlords scrutinize whether the tenant has a history of timely payments, any late payments, or any prior evictions. A positive rental payment history is a strong indicator of a tenant’s commitment to fulfilling their lease obligations.

Criminal Background Checks: Ensuring a Safe Living Environment

Safety is a paramount concern for landlords and neighbors alike. Conducting criminal background checks helps landlords identify any potential risks associated with a tenant. While having a criminal history doesn’t automatically disqualify a tenant, landlords use this information to assess whether the prospective tenant poses any safety concerns to the property and its residents.

Employment and Income Verification: Ensuring Financial Stability

Stable employment and a consistent income are crucial for tenants to meet their financial commitments. Landlords verify employment details and income to ensure that the tenant has the financial stability to cover rent and other living expenses. This step provides assurance to landlords that tenants can meet their lease obligations throughout the tenancy.

Reference Checks: Insights from Previous Landlords

Contacting previous landlords for references is a valuable step in the background check process. By speaking with former landlords, current landlords can gain insights into a tenant’s behavior, how well they maintained the property, and any issues encountered during their previous tenancies. This firsthand information contributes to a more holistic assessment.

Navigating Legal Compliance: Following Fair

Smart Strategies for Profitable Rental Property Investment

Smart Strategies for Profitable Rental Property Investment

Investing in rental properties can be a lucrative venture, but success requires careful planning, market awareness, and strategic decision-making. Whether you’re a seasoned investor or a newcomer to the real estate market, adopting smart strategies can enhance the profitability of your rental property investments.

Understanding Market Trends and Dynamics

Before diving into rental property investment, it’s crucial to understand current market trends and dynamics. Analyzing factors such as housing demand, rental prices, and economic indicators provides a foundation for informed decision-making. Regularly monitoring the market helps investors identify opportunities and potential challenges.

Location, Location, Location: Key to Investment Success

The age-old adage “location, location, location” holds true in real estate, especially in rental property investment. Choosing properties in desirable locations with good amenities, proximity to essential services, and a strong rental market increases the likelihood of attracting quality tenants and achieving better rental yields.

Financial Planning and Budgeting

Successful rental property investment requires careful financial planning and budgeting. Investors should consider not only the purchase price of the property but also additional costs such as maintenance, property management fees, and potential vacancies. Creating a realistic budget ensures investors are prepared for the full spectrum of expenses.

Tenant Screening and Quality Management

Ensuring a steady income stream involves thorough tenant screening and effective property management. Selecting reliable tenants who pay rent on time and maintain the property is essential. Quality property management, whether handled personally or through professional services, contributes to tenant satisfaction and property upkeep.

Adapting to Evolving Technology

Embracing technology is a key strategy in modern rental property investment. Online platforms for property searches, digital lease signings, and property management software streamline processes and enhance efficiency. Investors leveraging technology can stay competitive and provide a seamless experience for both tenants and themselves.

Tax Considerations and Incentives

Understanding tax considerations and incentives is crucial for maximizing returns on rental property investments. Investors should be aware of tax deductions related to property expenses, depreciation, and potential incentives offered by local governments to encourage property investment. Seeking advice from tax professionals ensures compliance with tax regulations.

Balancing Short-Term Gains with Long-Term Growth

While rental property investment can offer short-term gains through rental income, it’s essential to balance this with a focus on long-term growth. Property appreciation over time can significantly contribute to overall investment returns. Investors should have a clear strategy that aligns with their financial goals and timeline.

Continuous Education and Market Research

The real estate market is dynamic, and staying informed is an ongoing process. Continuous education and market research help investors adapt to changing trends, regulations, and economic conditions. Engaging in industry-related seminars, reading publications, and networking with other investors contribute to a well-informed investment approach.

Risk Mitigation Strategies

Investing always involves some level of risk, but savvy investors implement risk mitigation strategies. This includes diversifying the investment portfolio, having contingency plans for economic downturns, and staying financially resilient. Understanding the potential risks and having strategies in place helps investors navigate uncertainties.

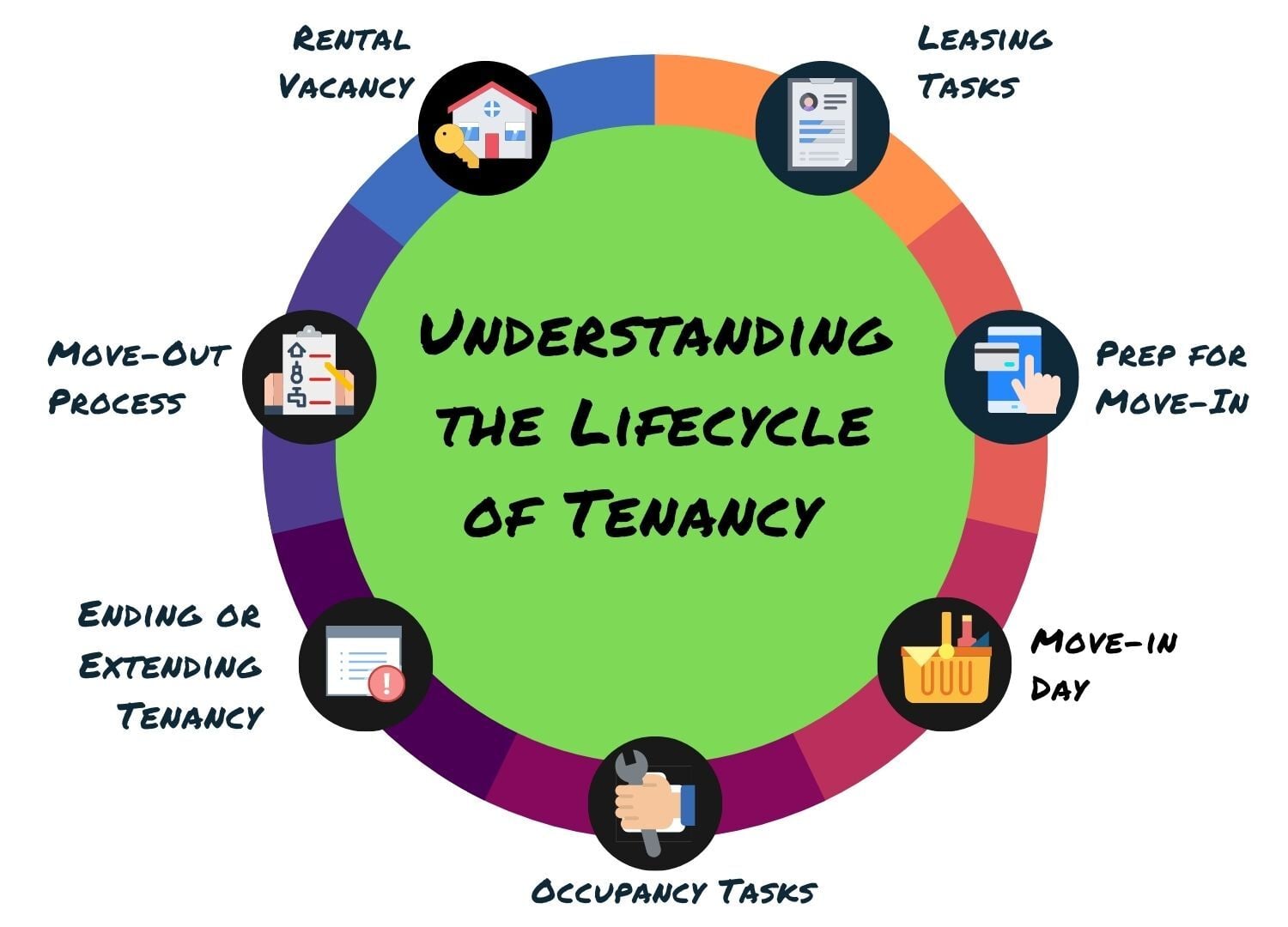

Efficient Rental Property Management for Success

Efficient Rental Property Management for Success

Successful rental property management goes beyond collecting rent; it involves comprehensive strategies to ensure the property’s well-being, tenant satisfaction, and financial success. Navigating the intricacies of property management requires a multifaceted approach that balances various responsibilities.

Clear Communication with Tenants

One of the cornerstones of efficient rental property management is clear communication with tenants. Establishing open lines of communication helps address concerns promptly, fostering a positive relationship between landlords and tenants. Regular communication also ensures that tenants are aware of their responsibilities and the property’s guidelines.

Thorough Tenant Screening Process

Efficient property management begins with a rigorous tenant screening process. This involves thorough background checks, assessing financial stability, and checking rental histories. A meticulous screening process helps ensure that tenants are reliable, responsible, and more likely to adhere to the terms of the lease agreement.

Effective Lease Agreement Management

Managing lease agreements effectively is crucial for maintaining a well-functioning rental property. This includes clearly outlining terms, setting expectations, and addressing any necessary legal considerations. Regularly reviewing and updating lease agreements as needed contributes to a smooth and compliant tenant-landlord relationship.

Proactive Property Maintenance

Proactive property maintenance is key to preserving the property’s value and ensuring tenant satisfaction. Regular inspections, prompt repairs, and addressing maintenance concerns swiftly contribute to a well-maintained property. A well-maintained property not only attracts quality tenants but also minimizes issues that can escalate over time.

Financial Management and Budgeting

Sound financial management is at the core of successful property management. This involves setting realistic rental prices, budgeting for maintenance and repairs, and diligently tracking income and expenses. Strategic financial planning ensures the property remains profitable while providing value to tenants.

Utilization of Technology in Property Management

In the digital age, leveraging technology is essential for efficient property management. Property management software can streamline tasks such as rent collection, lease tracking, and communication. Online platforms also provide convenient tools for property owners to manage various aspects of their rental properties more effectively.

Tenant Retention Strategies

Retaining quality tenants is a cost-effective strategy in property management. Establishing a positive living environment, addressing tenant concerns promptly, and offering incentives for lease renewals contribute to tenant satisfaction. Satisfied tenants are more likely to stay longer, reducing turnover costs and ensuring a steady income stream.

Legal Compliance and Stay Informed

Adhering to legal requirements is non-negotiable in property management. Property managers must stay informed about local rental laws, eviction procedures, and fair housing regulations. Compliance not only avoids legal issues but also fosters a trustworthy reputation in the rental market.

Emergency Preparedness and Response

Being prepared for emergencies is a vital aspect of property management. Property managers should have contingency plans for unforeseen events, such as natural disasters or urgent repairs. This preparedness ensures the safety of tenants, protects the property, and demonstrates responsible management.

Continual Education and Professional Development

The field of property management is dynamic, with laws, technologies, and best practices evolving. Property managers should engage in continual education and professional development to stay

Secure Screening Solutions for Reliable Tenant Selection

Secure Screening Solutions for Reliable Tenant Selection

In the realm of property management, ensuring the reliability and trustworthiness of tenants is paramount. Successful tenant screening is a crucial step in this process, as it helps property owners and managers make informed decisions about who to welcome into their rental spaces.

Why Tenant Screening Matters

Tenant screening serves as a safeguard, protecting property owners from potential risks associated with unreliable tenants. It involves a comprehensive evaluation of a tenant’s background, financial history, and rental track record. This multifaceted approach ensures that landlords make well-informed decisions and create a secure living environment for all residents.

Thorough Background Checks

One of the key components of tenant screening is a thorough background check. This process involves examining an applicant’s criminal history, credit report, and rental history. A clean background check provides peace of mind to landlords, indicating that the potential tenant is likely to be a responsible and trustworthy occupant.

Financial Stability as a Key Indicator

Financial stability is a crucial factor in determining a tenant’s reliability. A comprehensive tenant screening process includes an assessment of an applicant’s income, employment status, and overall financial health. This step ensures that tenants have the means to meet their financial obligations, reducing the risk of late or missed rent payments.

Rental History and References

Examining a tenant’s rental history and contacting previous landlords for references is an integral part of the screening process. This step provides insights into an applicant’s behavior as a tenant, including their adherence to lease agreements, treatment of property, and interactions with neighbors. Positive references from previous landlords strengthen the case for a potential tenant.

Legal Compliance and Fair Housing

Tenant screening must adhere to legal guidelines and fair housing laws. Property owners and managers should be well-versed in these regulations to ensure that their screening process is both effective and non-discriminatory. Failing to comply with these laws can result in legal consequences and damage a property owner’s reputation.

Utilizing Technology for Efficient Screening

In today’s digital age, technology plays a vital role in streamlining the tenant screening process. Online platforms and screening services offer convenient solutions for verifying information, conducting background checks, and assessing an applicant’s suitability as a tenant. Embracing these technological tools enhances the efficiency and accuracy of the screening process.

Choosing the Right Screening Partner

Selecting a reliable tenant screening service is crucial for the success of the process. A reputable screening partner provides accurate and up-to-date information, helping property owners make informed decisions. It is essential to choose a service that aligns with legal requirements and meets the specific needs of the property management team.

Tenant Screening at Walenshipnigltd.com

For a comprehensive and reliable tenant screening experience, consider partnering with Walenshipnigltd.com. Our screening solutions are designed to offer a seamless process, providing property owners with the information they need to make sound decisions. Visit Walenshipnigltd.com to explore our services and take the first step toward securing a trustworthy tenant for your property.

In conclusion, tenant screening is a

Securing Peace of Mind: The Importance of Background Checks

Securing Peace of Mind: The Importance of Background Checks

Background checks play a pivotal role in various aspects of life, offering a valuable tool to ensure safety, trust, and informed decision-making. Whether you are screening potential tenants, hiring employees, or engaging in financial transactions, understanding the importance of background checks can safeguard your interests and contribute to a secure living and working environment.

Enhancing Tenant Selection: A Prudent Approach to Leasing

For landlords and property managers, conducting thorough background checks is a prudent approach to tenant selection. These checks provide insights into an applicant’s rental history, creditworthiness, and criminal background. By assessing these factors, landlords can make informed decisions, mitigating the risk of potential issues during the tenancy period. This contributes to a more secure and stable rental experience for both landlords and tenants.

Verifying Employment Candidates: Building a Trustworthy Team

In the realm of employment, background checks are crucial for verifying the credentials and qualifications of potential candidates. Employers can delve into an applicant’s work history, educational background, and professional certifications. This thorough vetting process ensures that the selected candidates are qualified, trustworthy, and align with the company’s values, fostering a reliable and competent team.

Safeguarding Financial Transactions: Mitigating Risks

Background checks are essential when engaging in financial transactions, such as loans or partnerships. Assessing an individual or business entity’s financial history, creditworthiness, and potential legal issues helps in mitigating financial risks. This due diligence is particularly important for businesses entering into partnerships, ensuring a secure and stable financial environment.

Promoting Safer Communities: A Collective Responsibility

In a broader societal context, background checks contribute to promoting safer communities. Employers, landlords, and financial institutions collectively play a role in fostering environments where trust and security prevail. Thorough background screening helps identify potential risks, contributing to a safer and more harmonious community for everyone.

Ensuring Compliance with Regulations: Legal and Ethical Considerations

Engaging in background checks requires adherence to legal and ethical considerations. Privacy laws and regulations govern the extent to which background checks can be conducted. Organizations and individuals must ensure compliance with these regulations to uphold the rights of the individuals being screened. A transparent and legal approach to background checks fosters trust and credibility in the screening process.

Empowering Informed Decision-Making: Knowledge is Key

One of the primary benefits of background checks is the empowerment of informed decision-making. Whether it’s selecting a tenant, hiring an employee, or entering into a business partnership, having access to comprehensive background information enables individuals and organizations to make choices aligned with their values and goals. Knowledge is indeed key in making sound decisions that contribute to long-term success.

Accessing Professional Services: Expertise Matters

While the importance of background checks is clear, the process can be complex. Engaging professional background screening services brings expertise to the forefront. These services are well-versed in compliance, data security, and the nuances of various screening processes. Employing professionals ensures that the background checks are conducted thoroughly, accurately, and in accordance with legal standards.

The Role of Technology:

Choosing the Right Property Management: Expert Solutions for Landlords

Choosing the Right Property Management: Expert Solutions for Landlords

Property management companies play a pivotal role in easing the burden of landlords by handling the day-to-day operations of rental properties. This article explores the benefits of hiring a property management company and provides insights into selecting the right one for your investment.

Understanding the Role of Property Management Companies

Property management companies act as intermediaries between landlords and tenants, handling various responsibilities to ensure smooth operations. Their roles may include marketing rental properties, screening tenants, collecting rent, overseeing maintenance, and addressing tenant concerns. Understanding the breadth of their services is crucial when considering hiring one.

Benefits of Hiring a Property Management Company

One of the primary advantages of hiring a property management company is the time and stress it saves landlords. These professionals have the expertise to handle legalities, tenant issues, and property maintenance, allowing landlords to focus on other aspects of their lives or invest in additional properties. Additionally, property management companies often have access to a network of reliable contractors and service providers.

Efficient Tenant Screening Process

Tenant screening is a critical aspect of property management, and reputable companies excel in this area. They conduct thorough background checks, verify rental history, and assess financial capabilities to ensure that landlords have reliable and responsible tenants. This reduces the risk of late payments, property damage, or eviction issues.

Effective Marketing Strategies

Property management companies leverage their experience to implement effective marketing strategies. They know how to showcase rental properties, target the right audience, and use online platforms efficiently. This expertise can lead to quicker property occupancy and reduced vacancies, optimizing rental income for landlords.

Rent Collection and Financial Management

Handling rent collection can be a challenging task for landlords. Property management companies streamline this process by implementing efficient rent collection systems. Additionally, they provide financial management services, offering detailed reports on income and expenses, helping landlords maintain a clear overview of their property’s financial performance.

Prompt Maintenance and Repairs

Property maintenance is a key responsibility of management companies. They ensure that the property is well-maintained, addressing issues promptly and proactively. This not only preserves the property’s value but also contributes to tenant satisfaction. A well-maintained property attracts and retains quality tenants.

Navigating Legalities and Dispute Resolution

Property management companies are well-versed in landlord-tenant laws, ensuring that landlords remain compliant with regulations. In case of disputes or legal issues, these professionals have the knowledge and experience to navigate the complexities, potentially saving landlords from costly legal battles.

Personalized Service and Communication

While property management companies handle various tasks, a reputable one also prioritizes personalized service and communication. Landlords should feel comfortable discussing concerns, receiving regular updates on property performance, and having open lines of communication with their property management team.

Choosing the Right Property Management Company

Selecting the right property management company requires careful consideration. Research and compare companies, assessing their reputation, experience, and client reviews. Consider the range of services they offer and their fee structure. A reputable company will