Professional advice.

Renting with Bad Credit: Navigating Housing Challenges

Overcoming Hurdles: Renting with Bad Credit

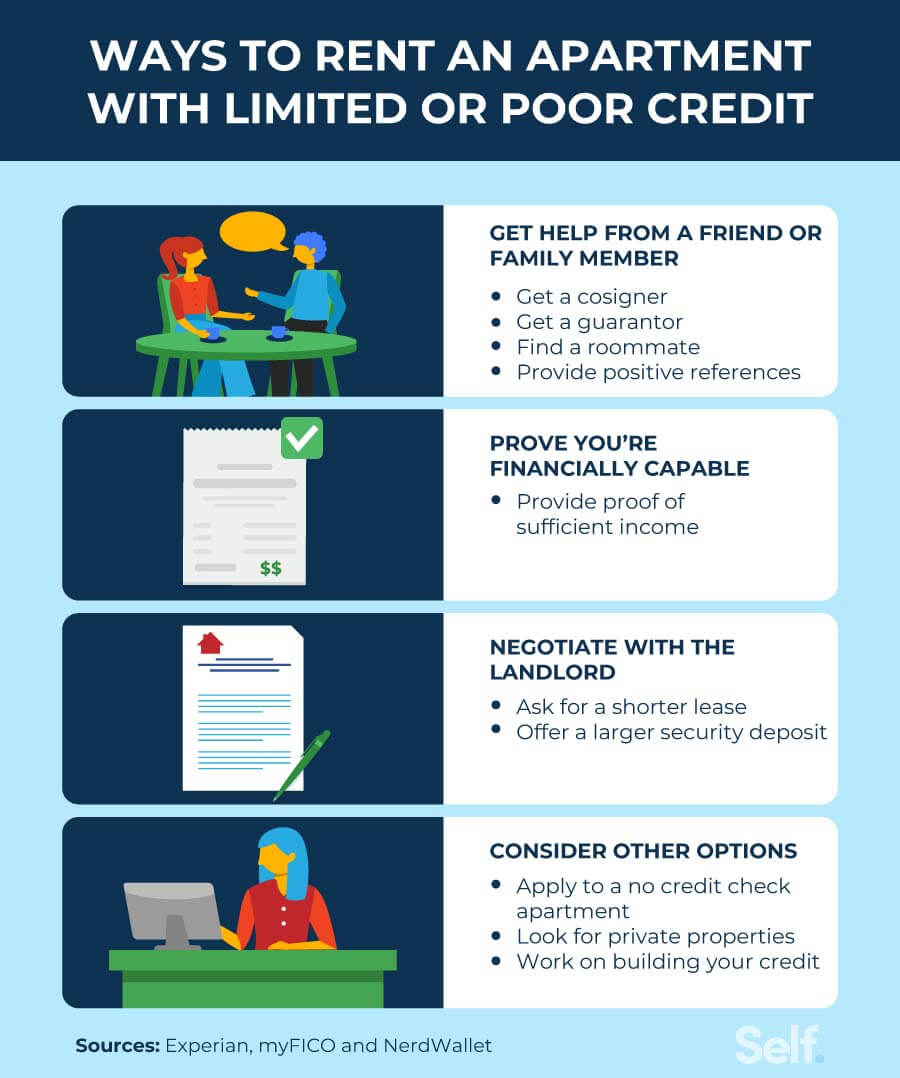

Renting with bad credit can be a challenging endeavor, but it’s not impossible. Understanding the hurdles, exploring proactive measures, and communicating effectively with landlords are key elements in navigating the process and securing a suitable rental arrangement.

The Impact of Bad Credit on Rental Applications

Bad credit can significantly impact the rental application process. Landlords often use credit scores as one of the criteria to assess a tenant’s financial responsibility. A low credit score may raise concerns about the tenant’s ability to pay rent consistently. However, it’s essential to recognize that bad credit does not automatically disqualify someone from finding suitable housing.

Building a Stronger Rental Application

To improve the chances of securing a rental despite bad credit, applicants can take proactive steps to strengthen their rental application. This may include providing additional references, such as previous landlords or employers, to vouch for reliability and responsibility. Offering a higher security deposit or prepaying rent for a few months in advance can also demonstrate commitment and financial stability.

Exploring Co-Signers and Guarantors

Having a co-signer or guarantor with a stronger credit history can significantly enhance the chances of approval. This individual agrees to assume financial responsibility if the tenant fails to meet their rental obligations. Landlords often find reassurance in having a co-signer or guarantor, making it a viable option for those with bad credit.

Emphasizing Rental History and References

Highlighting a positive rental history can offset the impact of bad credit. Providing references from previous landlords who can attest to on-time payments, responsible tenancy, and property upkeep can be influential. Demonstrating a commitment to fulfilling lease obligations in the past can help landlords feel more confident about renting to someone with a less-than-ideal credit score.

Being Transparent and Communicative

Open and honest communication is crucial when renting with bad credit. Being transparent about the reasons behind the credit challenges and outlining the steps taken to improve the situation can build trust with landlords. Discussing the circumstances upfront and providing a proactive explanation can set a positive tone for the application process.

Searching for Landlords Open to Flexibility

Not all landlords have strict credit score requirements. Some may be open to considering additional factors and listening to tenants’ explanations. Searching for landlords who prioritize other aspects of the application, such as rental history and references, can broaden the options for those with bad credit.

Utilizing Renting Platforms and Agencies

Certain renting platforms and agencies specialize in assisting individuals with unique renting situations, including bad credit. Exploring these resources can connect tenants with landlords who may be more flexible in their eligibility criteria. Working with professionals who understand the challenges of renting with bad credit can streamline the process.

Understanding Legal Protections

Tenants with bad credit still have legal protections, and it’s crucial to be aware of them. Discrimination based solely on credit history may be unlawful in some jurisdictions. Knowing tenant rights and understanding the applicable laws can empower individuals to navigate the rental process

Unlocking Value: Rental Property Appreciation Strategies

Unlocking Value: Rental Property Appreciation Strategies

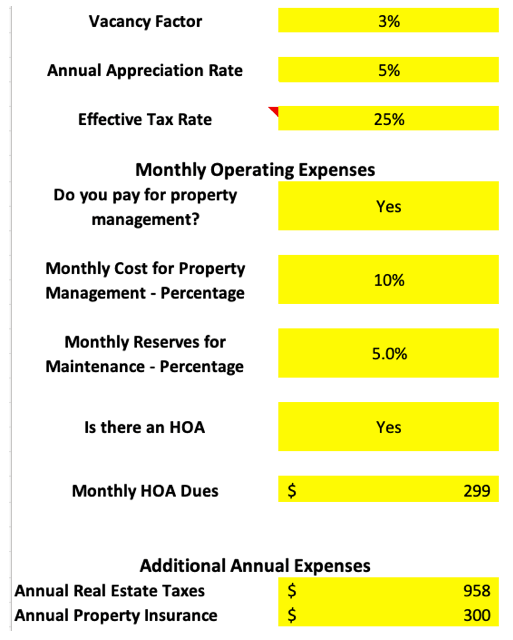

Investing in rental properties not only provides immediate rental income but also offers the potential for property appreciation over time. Understanding the factors influencing rental property appreciation and implementing strategic measures can significantly enhance the long-term value of your investment.

Factors Influencing Rental Property Appreciation

Several factors contribute to the appreciation of rental properties. Location, economic growth, development projects, and improvements in infrastructure can positively impact property values. Additionally, the overall real estate market conditions, including supply and demand dynamics, play a crucial role in determining the appreciation potential of rental properties.

Strategic Property Upgrades and Renovations

One effective strategy for enhancing rental property appreciation is to invest in strategic upgrades and renovations. Improving the property’s curb appeal, modernizing interiors, and incorporating energy-efficient features can attract higher-quality tenants and positively influence the property’s market value over time.

Proactive Maintenance and Careful Management

Regular maintenance and attentive property management contribute to rental property appreciation. Addressing maintenance issues promptly, conducting regular inspections, and ensuring the property is well-maintained create a positive impression. A well-managed property is more likely to retain its value and appreciate over the years.

Adapting to Market Trends and Demands

Staying informed about market trends and tenant demands is crucial for maximizing rental property appreciation. Understanding what features and amenities are currently in demand allows landlords to adapt their properties to meet market expectations. This adaptability enhances the property’s attractiveness and potential for appreciation.

Long-Term Lease Agreements and Stable Tenancy

Securing long-term lease agreements with stable tenants can contribute to rental property appreciation. A consistent rental income stream and lower turnover rates positively impact the property’s overall performance. Long-term tenants who treat the property with care and respect can help maintain its condition and desirability.

Monitoring Economic Indicators

Economic indicators, such as job growth, population growth, and local economic development, directly influence rental property appreciation. Investing in areas with positive economic prospects increases the likelihood of property values appreciating over time. Regularly monitoring these indicators allows investors to make informed decisions.

Smart Financing and Mortgage Management

Optimizing financing arrangements and managing mortgages intelligently can impact the potential for rental property appreciation. Securing favorable mortgage terms, refinancing when beneficial, and exploring financing options can contribute to improved cash flow and overall property value growth.

Diversification for Risk Mitigation

Diversifying your rental property portfolio is a prudent strategy for mitigating risk and enhancing appreciation potential. Investing in properties across different locations or types can provide a buffer against market fluctuations. Diversification spreads risk and increases the likelihood of overall portfolio appreciation.

Engaging with Local Community Development

Active engagement with local community development initiatives can positively influence rental property appreciation. Supporting and participating in neighborhood improvement projects, advocating for infrastructure enhancements, and contributing to community development can foster an environment where property values are likely to appreciate.

Leveraging Professional Advice and Resources

For landlords seeking to optimize rental property appreciation, leveraging professional advice and resources is invaluable. Seeking guidance from real estate experts, financial advisors, and

Clarifying Lease Renewal Terms: A Guide for Landlords and Tenants

Navigating Lease Renewal Terms: A Guide for Clarity

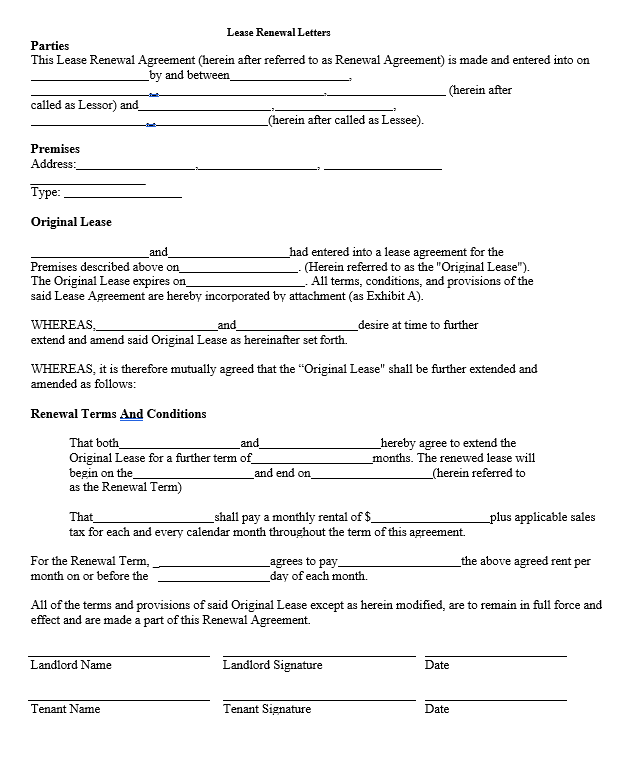

Lease renewal is a common process in the landlord-tenant relationship, but the terms involved can sometimes be complex. This guide aims to provide landlords and tenants with insights into clarifying lease renewal terms, fostering transparent and mutually beneficial agreements.

Understanding the Existing Lease Agreement

Before delving into lease renewal terms, both landlords and tenants should thoroughly understand the existing lease agreement. This involves reviewing the original terms, conditions, and any amendments made during the previous lease period. Clear comprehension of the current agreement forms the basis for discussing and clarifying renewal terms.

1. Clarifying Renewal Notice Periods

One of the critical aspects of lease renewal is understanding and clarifying the notice periods involved. Landlords typically set specific time frames within which tenants must notify them of their intention to renew or terminate the lease. Clarifying these notice periods helps avoid misunderstandings and ensures compliance with the agreed-upon terms.

2. Rent Adjustment Procedures and Transparency

Lease renewal often involves discussions about rent adjustments. Landlords and tenants should openly communicate about the procedures for determining rent changes. Transparency in how rent adjustments are calculated, whether based on market rates or specific factors, helps build trust and ensures that both parties are on the same page.

3. Negotiating Lease Duration

The duration of the renewed lease is a crucial aspect that requires clarification. Some landlords may prefer longer lease terms for stability, while tenants might seek shorter terms for flexibility. Negotiating and clarifying the lease duration ensures that both parties are comfortable with the commitment and aligns with their respective needs.

4. Exploring Renewal Incentives and Benefits

To encourage lease renewals, landlords often offer incentives or benefits to tenants. This could include a rent discount, upgrades to the property, or other perks. Clarifying the availability and terms of such incentives during lease renewal discussions provides tenants with additional considerations in their decision-making process.

5. Maintenance and Property Condition Expectations

Lease renewal discussions are an opportune time to clarify expectations regarding property maintenance. Landlords should communicate any planned maintenance or improvements and address any outstanding concerns raised by tenants. Clear agreements on maintenance responsibilities contribute to a positive living experience.

6. Addressing Changes in Property Policies

Over time, landlords may introduce changes to property policies or rules. Lease renewal discussions should include clarification on any new policies that may affect tenants. Whether it’s updated pet policies, parking regulations, or other rules, ensuring that tenants are aware and understand these changes is crucial for a harmonious living environment.

7. Provisions for Early Lease Termination

In some cases, tenants may need to terminate a renewed lease earlier than anticipated. Clarifying the provisions for early termination, including notice requirements and potential penalties, is essential. This provides both landlords and tenants with a clear understanding of the process and potential consequences.

8. Seeking Professional Advice

For complex lease renewal terms or situations involving legal considerations, seeking professional advice is advisable. Both landlords and tenants can benefit from consulting legal experts

Strategic Tips for Successful Lease Renewal Negotiations

Strategic Tips for Successful Lease Renewal Negotiations

Lease renewal negotiations can be a pivotal moment for both tenants and landlords. Approaching this process strategically is key to reaching favorable terms for all parties involved. Here are essential tips to navigate lease renewal negotiations effectively.

Understanding the Current Rental Market

Before entering into lease renewal negotiations, tenants should research and understand the current state of the rental market in their area. Knowledge of market trends, average rental rates, and vacancy rates empowers tenants to negotiate from an informed position. This understanding provides a benchmark for assessing the fairness of proposed terms.

1. Start Early and Communicate Promptly

Early communication is fundamental to successful lease renewal negotiations. Tenants should initiate discussions well in advance of the lease expiration date. This allows both parties ample time to consider terms, negotiate, and avoid the pressure of last-minute decisions. Open and prompt communication sets a positive tone for the negotiation process.

2. Evaluate Your Rental History

Tenants with a positive rental history, including on-time payments and adherence to lease terms, have a strong negotiating position. Highlighting a history of responsible tenancy can be a compelling argument for favorable lease renewal terms. Documenting this history provides tangible evidence of a tenant’s reliability.

3. Assess the Property’s Condition

Landlords are more likely to consider favorable terms for tenants who have maintained the property well. Conduct a thorough assessment of the property’s condition, addressing any necessary repairs or maintenance. Presenting a well-maintained property enhances a tenant’s credibility and strengthens their negotiating position.

4. Research Comparable Rentals

To support their negotiation stance, tenants should research comparable rentals in the area. If similar properties are leasing at lower rates or offering more favorable terms, tenants can use this information to negotiate for competitive terms. Knowledge of the local rental market dynamics is a powerful tool in negotiations.

5. Prioritize Key Lease Terms

Identify key lease terms that are particularly important to you as a tenant. Whether it’s the rental rate, lease duration, or specific property features, prioritizing these terms helps focus the negotiation on critical aspects. Flexibility on less crucial terms can be employed to secure favorable conditions for the most important ones.

6. Propose Incremental Changes

When presenting desired changes to the lease terms, proposing incremental adjustments can be more effective than radical shifts. Gradual changes may be more palatable for landlords, increasing the likelihood of agreement. Clear and reasoned proposals help landlords understand the tenant’s perspective.

7. Seek Professional Advice if Needed

For tenants facing complex lease renewal negotiations or dealing with unique circumstances, seeking professional advice can be beneficial. Consulting with a real estate attorney or tenant advocacy service provides valuable insights and ensures that tenants understand their rights and options during the negotiation process.

8. Negotiate Beyond the Rent

Lease renewal negotiations aren’t solely about the rental rate. Tenants can explore other aspects of the lease, such as maintenance responsibilities, pet policies, or lease termination conditions. Negotiating beyond the rent allows tenants to tailor the lease