Flexible landlords

Renting with Bad Credit: Navigating Housing Challenges

Overcoming Hurdles: Renting with Bad Credit

Renting with bad credit can be a challenging endeavor, but it’s not impossible. Understanding the hurdles, exploring proactive measures, and communicating effectively with landlords are key elements in navigating the process and securing a suitable rental arrangement.

The Impact of Bad Credit on Rental Applications

Bad credit can significantly impact the rental application process. Landlords often use credit scores as one of the criteria to assess a tenant’s financial responsibility. A low credit score may raise concerns about the tenant’s ability to pay rent consistently. However, it’s essential to recognize that bad credit does not automatically disqualify someone from finding suitable housing.

Building a Stronger Rental Application

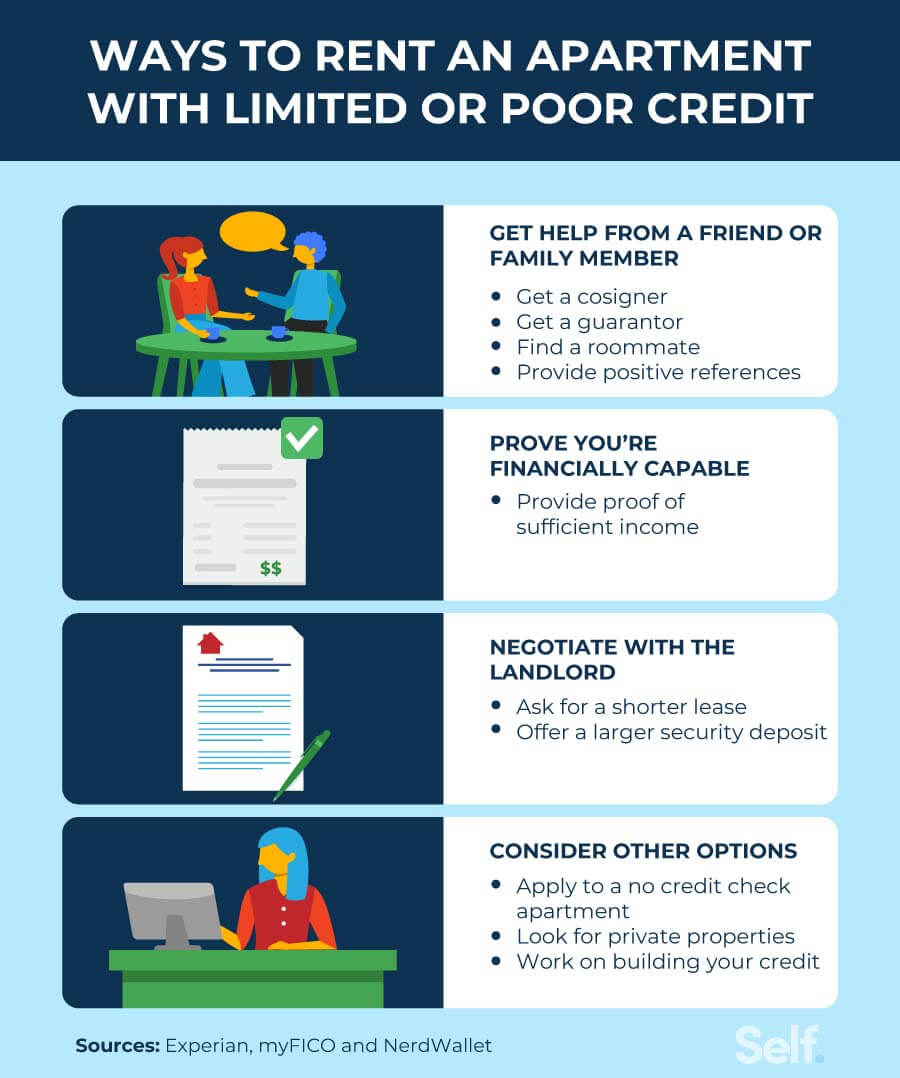

To improve the chances of securing a rental despite bad credit, applicants can take proactive steps to strengthen their rental application. This may include providing additional references, such as previous landlords or employers, to vouch for reliability and responsibility. Offering a higher security deposit or prepaying rent for a few months in advance can also demonstrate commitment and financial stability.

Exploring Co-Signers and Guarantors

Having a co-signer or guarantor with a stronger credit history can significantly enhance the chances of approval. This individual agrees to assume financial responsibility if the tenant fails to meet their rental obligations. Landlords often find reassurance in having a co-signer or guarantor, making it a viable option for those with bad credit.

Emphasizing Rental History and References

Highlighting a positive rental history can offset the impact of bad credit. Providing references from previous landlords who can attest to on-time payments, responsible tenancy, and property upkeep can be influential. Demonstrating a commitment to fulfilling lease obligations in the past can help landlords feel more confident about renting to someone with a less-than-ideal credit score.

Being Transparent and Communicative

Open and honest communication is crucial when renting with bad credit. Being transparent about the reasons behind the credit challenges and outlining the steps taken to improve the situation can build trust with landlords. Discussing the circumstances upfront and providing a proactive explanation can set a positive tone for the application process.

Searching for Landlords Open to Flexibility

Not all landlords have strict credit score requirements. Some may be open to considering additional factors and listening to tenants’ explanations. Searching for landlords who prioritize other aspects of the application, such as rental history and references, can broaden the options for those with bad credit.

Utilizing Renting Platforms and Agencies

Certain renting platforms and agencies specialize in assisting individuals with unique renting situations, including bad credit. Exploring these resources can connect tenants with landlords who may be more flexible in their eligibility criteria. Working with professionals who understand the challenges of renting with bad credit can streamline the process.

Understanding Legal Protections

Tenants with bad credit still have legal protections, and it’s crucial to be aware of them. Discrimination based solely on credit history may be unlawful in some jurisdictions. Knowing tenant rights and understanding the applicable laws can empower individuals to navigate the rental process