Income assessment

Screening Tenants: Mastering Rental Background Checks

Navigating the Tenant Landscape: The Art of Rental Background Checks

Securing reliable and responsible tenants is a paramount concern for landlords. The key to achieving this lies in conducting thorough rental background checks. These checks provide valuable insights into a prospective tenant’s history, financial stability, and overall suitability for a rental property. In this article, we explore the nuances of rental background checks, from their importance to the steps involved in the screening process.

Understanding the Significance: Why Rental Background Checks Matter

Rental background checks serve as a critical tool for landlords to assess the risk associated with potential tenants. By delving into a tenant’s past, landlords can gauge their financial responsibility, rental history, and potential red flags. This comprehensive evaluation enables landlords to make informed decisions, minimizing the likelihood of problematic tenancies and fostering a positive living environment for all residents.

Components of a Comprehensive Check: What to Look For

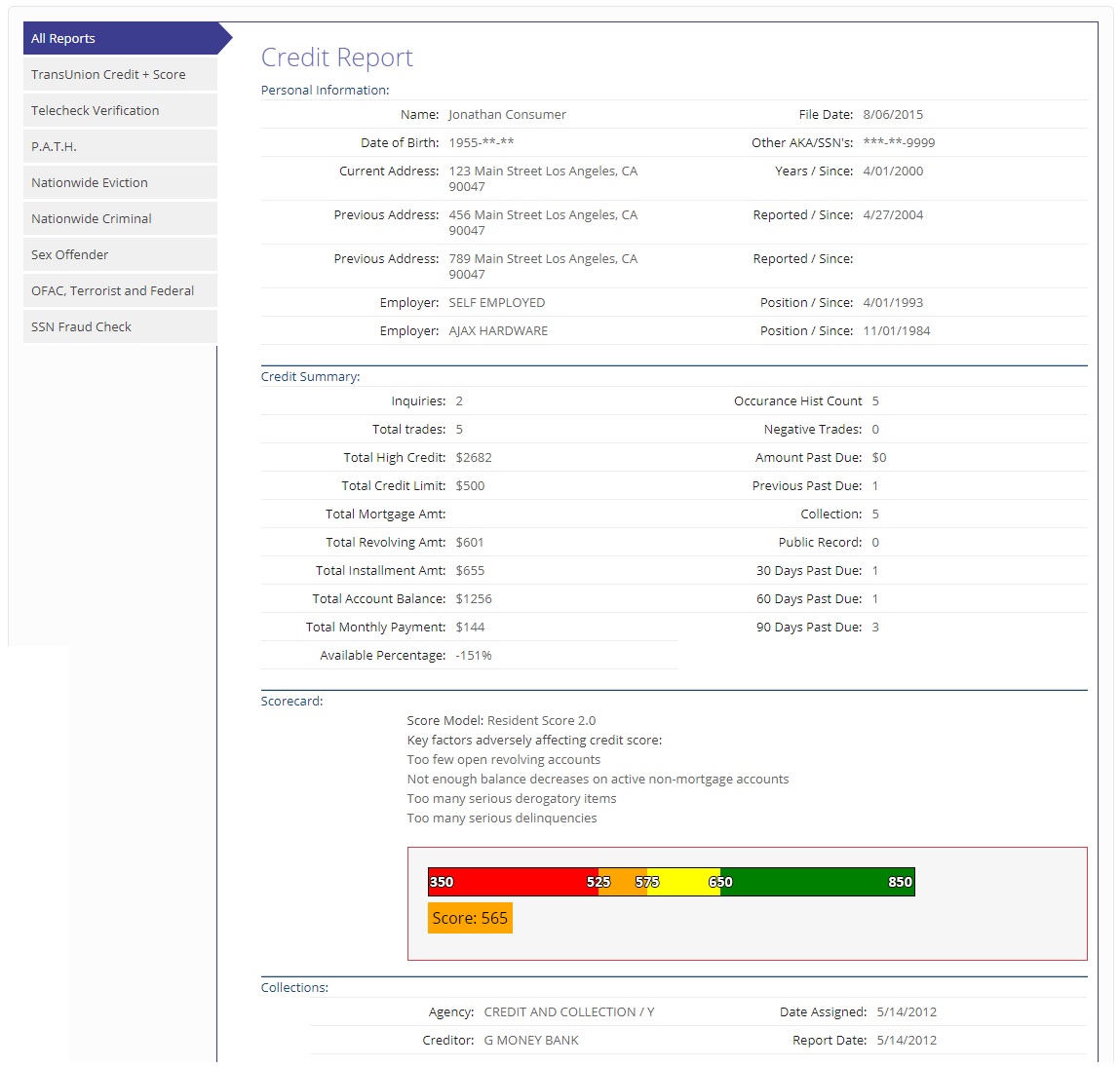

A comprehensive rental background check encompasses various components. Key aspects include a tenant’s credit history, rental payment history, criminal background, employment and income verification, and references from previous landlords. Each of these elements contributes to the overall picture, helping landlords assess a tenant’s ability to meet financial obligations and maintain a good rental record.

Credit History: Unveiling Financial Responsibility

One of the crucial elements in a background check is a tenant’s credit history. This reveals their financial responsibility and how well they manage debts and financial commitments. Landlords typically look for a satisfactory credit score, indicating a tenant’s ability to meet rent payments and other financial obligations consistently.

Rental Payment History: A Window into Tenant Reliability

Examining a tenant’s rental payment history provides insights into their reliability as renters. Landlords scrutinize whether the tenant has a history of timely payments, any late payments, or any prior evictions. A positive rental payment history is a strong indicator of a tenant’s commitment to fulfilling their lease obligations.

Criminal Background Checks: Ensuring a Safe Living Environment

Safety is a paramount concern for landlords and neighbors alike. Conducting criminal background checks helps landlords identify any potential risks associated with a tenant. While having a criminal history doesn’t automatically disqualify a tenant, landlords use this information to assess whether the prospective tenant poses any safety concerns to the property and its residents.

Employment and Income Verification: Ensuring Financial Stability

Stable employment and a consistent income are crucial for tenants to meet their financial commitments. Landlords verify employment details and income to ensure that the tenant has the financial stability to cover rent and other living expenses. This step provides assurance to landlords that tenants can meet their lease obligations throughout the tenancy.

Reference Checks: Insights from Previous Landlords

Contacting previous landlords for references is a valuable step in the background check process. By speaking with former landlords, current landlords can gain insights into a tenant’s behavior, how well they maintained the property, and any issues encountered during their previous tenancies. This firsthand information contributes to a more holistic assessment.

Navigating Legal Compliance: Following Fair