Record-keeping.

Tax Strategies for Rental Properties: Maximizing Returns and Compliance

Tax Strategies for Rental Properties: Maximizing Returns and Compliance

Investing in rental properties offers potential financial gains, but understanding the intricacies of rental property taxation is crucial for both landlords and investors. Implementing effective tax strategies not only maximizes returns but also ensures compliance with applicable tax laws.

Navigating Tax Deductions for Rental Properties

One of the key aspects of rental property taxation is understanding and leveraging available tax deductions. Landlords can typically deduct expenses such as mortgage interest, property taxes, insurance, maintenance costs, and depreciation. Keeping meticulous records of these expenses is essential for accurate tax reporting.

Depreciation and its Impact on Taxes

Depreciation is a significant tax benefit for rental property owners. While the property may appreciate in value over time, the IRS allows landlords to claim depreciation as an expense. This non-cash deduction reduces taxable income, providing a valuable tax advantage for property investors.

Understanding Passive Activity Loss Rules

Passive activity loss rules come into play when rental property owners incur more expenses than income. It’s essential to comprehend these rules to navigate the tax implications effectively. Losses from rental activities may be limited, and understanding how these rules apply is crucial for tax planning.

Tax Implications of Rental Income

Rental income is subject to taxation, but the way it is taxed depends on various factors. Landlords may be taxed at their ordinary income tax rate on rental profits. However, qualifying real estate professionals or those with active involvement in property management may benefit from different tax treatment.

Utilizing 1031 Exchanges for Tax Deferral

Investors looking to defer taxes on capital gains from the sale of a rental property can explore 1031 exchanges. This provision allows for the exchange of one investment property for another without immediate tax consequences. Properly executed, a 1031 exchange can facilitate the growth of a real estate portfolio.

Tax Considerations for Short-Term Rentals

For landlords engaging in short-term rentals, tax considerations may differ. Income generated from short-term rentals is typically treated as ordinary income, and expenses can be deducted accordingly. Understanding the specific tax rules for short-term rentals is vital for accurate reporting.

State and Local Tax Variations

Tax laws can vary significantly at the state and local levels. It’s crucial for landlords to be aware of and comply with regional tax regulations related to rental properties. Consulting with tax professionals familiar with local tax codes ensures accurate reporting and compliance.

Record Keeping and Documentation

Thorough record-keeping is a fundamental aspect of effective rental property taxation. Maintaining organized records of income, expenses, and relevant documents allows landlords to substantiate deductions and comply with tax regulations. Digital tools and software can simplify the record-keeping process.

Tax Planning and Professional Guidance

Engaging in proactive tax planning is essential for rental property owners. Seeking professional guidance from tax advisors or accountants specializing in real estate can provide valuable insights. Professionals can help landlords optimize their tax positions, navigate complex regulations, and stay informed about changes in tax laws.

Staying Informed About Tax Law Changes

Tax

Efficient Rental Payment Methods: Streamlining Your Financial Transactions

Streamlining Financial Transactions: Exploring Rental Payment Methods

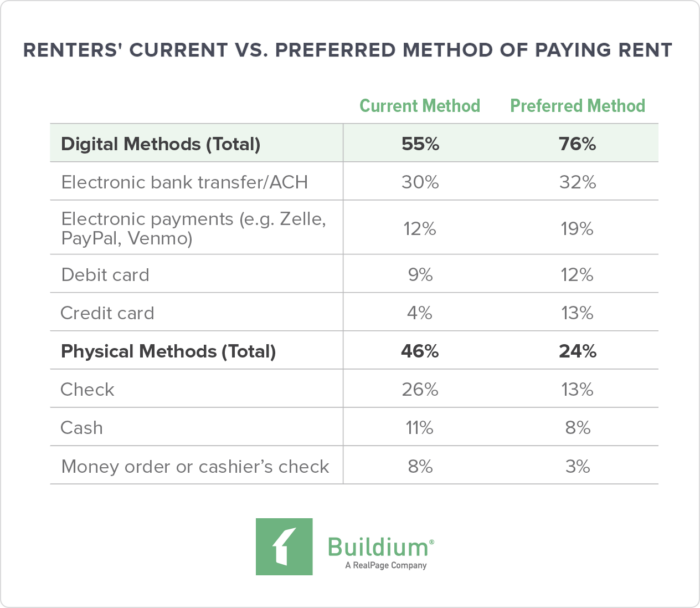

Efficient and reliable rental payment methods are crucial for both landlords and tenants. Navigating the diverse options available and choosing the right payment method can contribute to a smooth and hassle-free rental experience. In this article, we’ll delve into various rental payment methods, highlighting their advantages, considerations, and the importance of selecting the most suitable option for your specific circumstances.

Traditional Methods: Checks and Cash Transactions

Traditionally, rental payments were often made through checks or cash transactions. While some landlords still accept these methods, there are inherent challenges. Checks can be lost or delayed, leading to potential payment issues. Cash transactions, on the other hand, lack a traceable record and may pose security concerns for both parties. In today’s digital age, exploring more efficient options is advisable.

Bank Transfers and Direct Deposits: Electronic Convenience

Bank transfers and direct deposits have become increasingly popular due to their convenience and efficiency. Tenants can set up recurring transfers, ensuring that rent is automatically deposited into the landlord’s account on a specified date. This eliminates the need for physical checks, reduces the risk of late payments, and provides a clear transaction record for both parties.

Online Payment Platforms: Secure and Transparent Transactions

The rise of online payment platforms has revolutionized rental transactions. Services like PayPal, Venmo, and various property management platforms offer secure and transparent payment options. Tenants can make payments with a few clicks, and landlords receive funds directly into their accounts. Additionally, these platforms often provide features like automatic rent reminders and payment tracking.

Credit and Debit Card Payments: Convenience with Caution

Accepting credit and debit card payments can be convenient for tenants, offering flexibility in payment timing. However, landlords need to be aware of associated fees, which can cut into the rental income. Additionally, not all landlords may have the infrastructure in place to process card payments, so this option requires careful consideration and clear communication between parties.

Mobile Payment Apps: On-the-Go Solutions

Mobile payment apps, such as Cash App and Zelle, provide on-the-go solutions for tenants and landlords alike. These apps allow quick and easy transfers from a mobile device, streamlining the payment process. It’s essential to ensure that both parties have compatible apps and that transactions are conducted securely to prevent potential issues.

Cryptocurrency Transactions: Emerging Trends

While still in the early stages, some landlords and tenants explore cryptocurrency transactions for rental payments. Bitcoin and other cryptocurrencies offer the potential for borderless transactions and increased privacy. However, the volatility of cryptocurrencies and the limited acceptance in the rental market make this option less mainstream and more speculative.

Considering Tenant Preferences: Open Communication

Understanding tenant preferences is crucial when choosing a rental payment method. Some tenants may prefer the convenience of online platforms, while others may feel more comfortable with traditional methods. Open communication between landlords and tenants ensures that the chosen payment method aligns with both parties’ preferences and capabilities.

Legal and Regulatory Considerations: Compliance Matters

Landlords must consider legal and regulatory