In-person inspections

Avoiding Rental Scams: Smart Tips for Safe Housing Searches

Unmasking Deception: Navigating the Landscape of Rental Scams

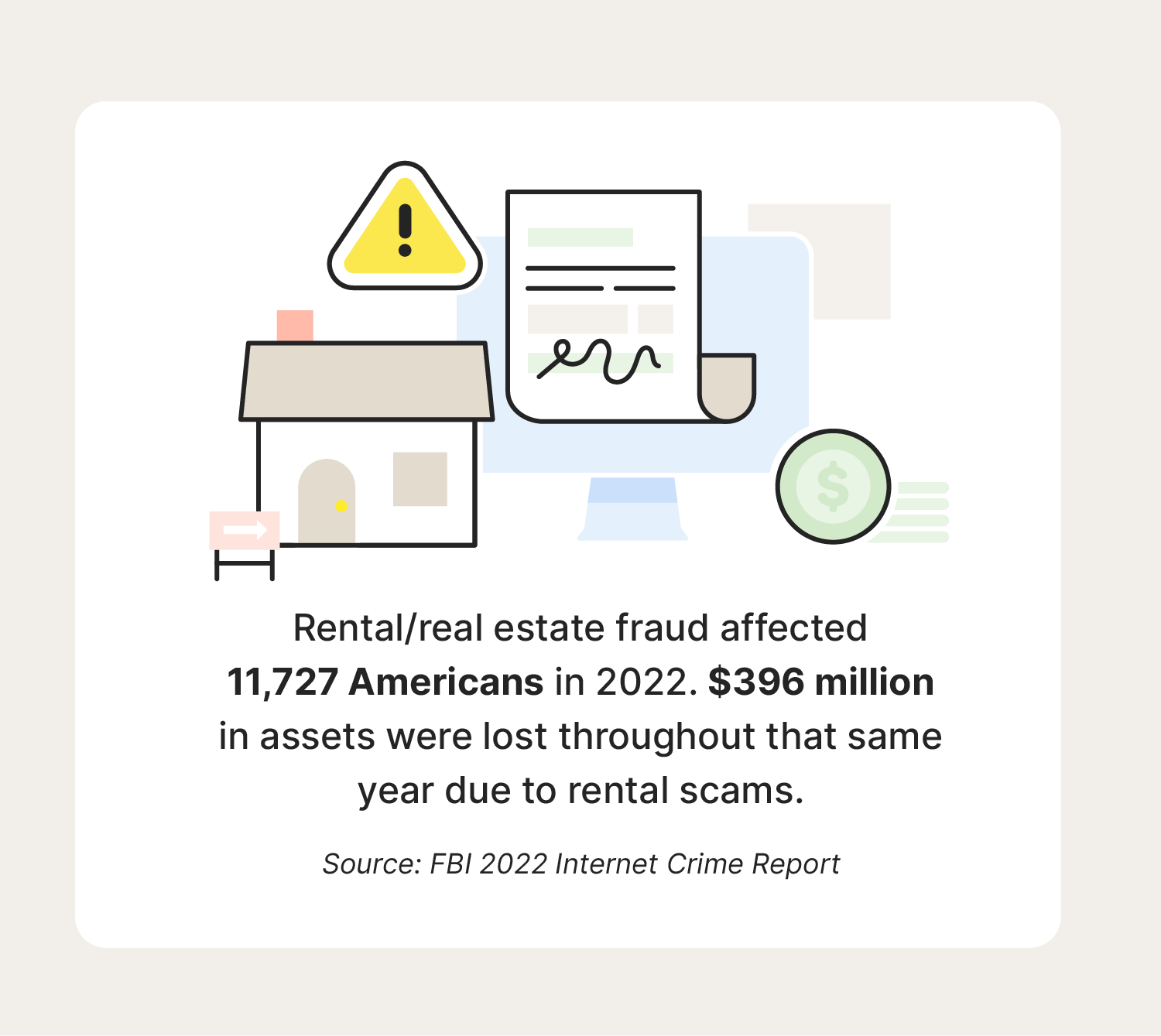

Rental scams continue to pose a threat to individuals searching for housing. As the demand for rental properties rises, scammers devise increasingly sophisticated schemes to exploit unsuspecting tenants. Understanding the signs of rental scams and adopting preventive measures is crucial to secure a safe and legitimate housing arrangement.

Identifying Common Red Flags

Recognizing the red flags of rental scams is the first line of defense for prospective tenants. Unusually low rental prices, requests for upfront payments before viewing the property, and landlords unwilling to provide a lease agreement are common indicators of fraudulent activities. Being vigilant and questioning suspicious practices can help individuals steer clear of potential scams.

Phantom Listings and Fake Ads

Scammers often create phantom rental listings using genuine property details obtained from legitimate sources. These fake ads lure potential tenants with attractive rental prices and appealing property features. To avoid falling victim to such scams, individuals should verify the legitimacy of listings through multiple sources and conduct thorough research before engaging with property ads.

Wire Transfers and Unsecured Payments

One prevalent tactic employed by rental scammers is the insistence on wire transfers or other unsecured forms of payment. Legitimate landlords typically accept payments through secure methods, such as checks, bank transfers, or reputable online platforms. Tenants should exercise caution if a landlord demands immediate payment via unconventional and untraceable channels.

Pressure Tactics and Urgency Appeals

Scammers often employ pressure tactics, creating a sense of urgency to manipulate tenants into hasty decisions. Claims of numerous applicants vying for the same property or offers that seem too good to be true are warning signs. Genuine landlords respect tenants’ decision-making timeframes and do not pressure them into immediate commitments.

Fake Landlords and Identity Theft

In some rental scams, individuals posing as landlords may request personal information from tenants. This opens the door to identity theft and potential financial loss. Legitimate landlords typically request information through secure channels and provide proper documentation to establish their identity. Tenants should be wary of landlords unwilling to share verifiable details.

Online Platforms and Verification Protocols

Utilizing reputable online platforms for housing searches is a proactive measure against rental scams. Established websites often have verification protocols and user reviews that add a layer of security. Prospective tenants should prioritize platforms with a track record of legitimacy and exercise caution on lesser-known or unverified websites.

In-Person Property Inspections and Meetings

To authenticate the legitimacy of a rental arrangement, in-person property inspections and meetings with landlords are crucial. Scammers may avoid face-to-face interactions and discourage property visits. Prospective tenants should insist on inspecting the property and meeting the landlord in person before making any financial commitments.

Legal Assistance and Document Verification

Engaging legal assistance can provide an additional layer of protection against rental scams. Legal professionals can review lease agreements, verify property ownership, and ensure that tenants’ rights are safeguarded. Seeking legal advice before signing any documents can prevent potential legal entanglements resulting from fraudulent activities.

Community Awareness and