Guarantor responsibilities

Lease Co-signers: Strengthening Rental Applications

Navigating Lease Co-signers: Bolstering Rental Applications

Securing a rental can be challenging, especially when facing hurdles like a limited credit history or income. In such cases, having a lease co-signer can make a substantial difference. Understanding the role of co-signers, their responsibilities, and how to approach this arrangement is essential for tenants seeking to strengthen their rental applications.

The Role of Lease Co-signers in Rental Applications

A lease co-signer, also known as a guarantor, is an individual who agrees to assume financial responsibility for the lease if the primary tenant is unable to meet their obligations. This person essentially acts as a backup, providing landlords with an additional layer of assurance regarding the tenant’s ability to pay rent on time and fulfill other lease commitments.

When and Why a Co-signer is Needed

Landlords may request a co-signer in situations where the primary tenant has insufficient income, a limited credit history, or a low credit score. These factors might raise concerns about the tenant’s financial stability, making landlords hesitant to approve the application on their own. A co-signer helps mitigate these concerns, increasing the likelihood of the application being accepted.

Choosing the Right Co-signer: Considerations and Criteria

Selecting an appropriate co-signer is a crucial aspect of this arrangement. Ideally, a co-signer should have a strong credit history, a stable income, and a willingness to take on the financial responsibility outlined in the lease agreement. Parents, relatives, or close friends are common choices as co-signers, but anyone willing to fulfill the role and meet the criteria can serve in this capacity.

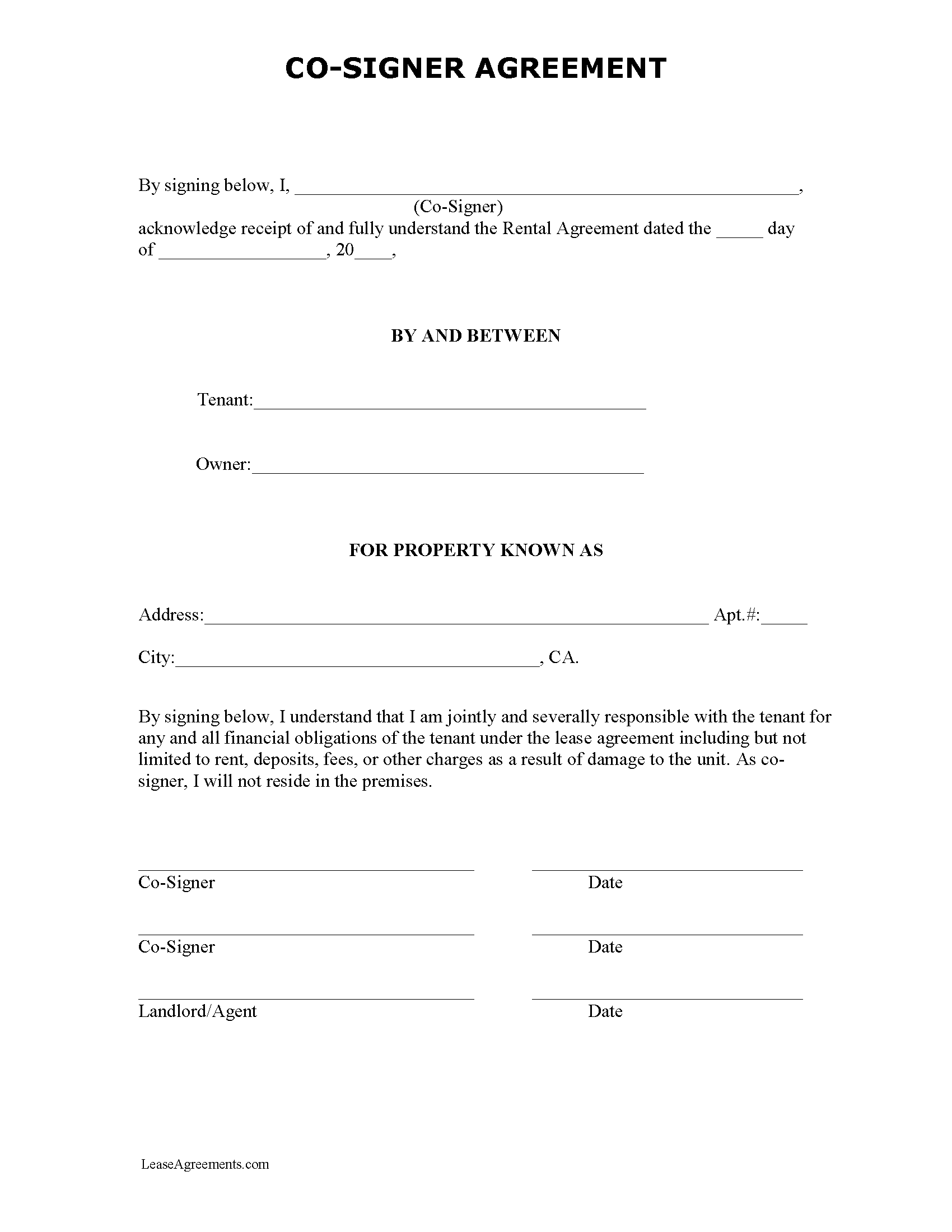

The Co-signer Agreement: Clear Terms and Responsibilities

Before finalizing the co-signer arrangement, it’s essential to establish clear terms and responsibilities. This includes outlining the specific obligations of the co-signer, such as covering rent payments, late fees, and any damages if the primary tenant fails to do so. Having a legally binding agreement in place protects both parties and ensures a transparent understanding of the arrangement.

Communicating Openly with Co-signers

Open communication between the primary tenant and the co-signer is crucial for a successful arrangement. The primary tenant should clearly communicate the terms of the lease, the reasons for requiring a co-signer, and any expectations regarding ongoing communication. This transparency fosters a positive and cooperative relationship, benefiting all parties involved.

Seeking Co-signer Approval: Approaching the Conversation

Approaching someone to be a co-signer is a significant request. It’s important to present the request professionally, providing information about the rental, explaining the need for a co-signer, and addressing any concerns they may have. Being upfront about expectations and expressing gratitude for their assistance increases the likelihood of a positive response.

Understanding Co-signer Risks: Potential Implications

While co-signers play a crucial role in helping tenants secure rentals, it’s essential to recognize the risks involved. Co-signers are financially responsible if the primary tenant defaults on their obligations. This can strain relationships if not handled properly. Therefore, tenants should prioritize fulfilling their lease commitments to maintain trust with their co-signers.

Alternatives to Co-signers: Exploring Other Options

In