Alternative housing options

Renew or Redefine: Lease Extension Options for Tenants

Renew or Redefine: Lease Extension Options for Tenants

Lease renewals are pivotal moments for both landlords and tenants. This article explores the various lease renewal options available to tenants, offering insights into the decision-making process and considerations that can shape their living arrangements.

Understanding Standard Lease Renewals

The standard lease renewal is a straightforward option where tenants have the opportunity to extend their existing lease for another fixed term. This option provides stability and continuity, allowing tenants to remain in their current living space without significant changes.

1. Negotiating Renewal Terms

For tenants who wish to renew their lease but with specific adjustments, negotiating renewal terms is a viable option. This could involve discussions about rent adjustments, lease duration, or other terms that better align with the tenant’s preferences. Open communication with the landlord is key during these negotiations.

2. Exploring Month-to-Month Leases

Some tenants prefer flexibility over long-term commitments. Opting for a month-to-month lease renewal offers this flexibility, allowing tenants to renew their lease on a monthly basis. While this option provides short-term flexibility, tenants should be aware that landlords may have the right to terminate with proper notice.

3. Considering Long-Term Commitments

On the other end of the spectrum, tenants may explore long-term commitments by opting for extended lease durations. This can provide a sense of security and potentially lock in the current rental rate for an extended period. Long-term commitments benefit both landlords and tenants seeking stability.

4. Assessing Property Upgrades or Changes

Lease renewal options can also include discussions about property upgrades or changes. Tenants interested in specific improvements to the property, such as renovations or appliance upgrades, can negotiate these aspects during the lease renewal process. Clear communication and agreement on these changes are essential.

5. Factoring in Rent Control Laws

In some regions, rent control laws may impact lease renewal options. Tenants should be aware of any applicable rent control regulations that could influence the renewal process. Understanding these laws helps tenants make informed decisions and ensures compliance with local regulations.

6. Evaluating Personal and Professional Plans

Lease renewal decisions often hinge on tenants’ personal and professional plans. Considerations such as job relocations, changes in family size, or other life events may influence the preferred lease renewal option. Aligning the renewal decision with broader life plans is crucial for tenants.

7. Seeking Legal Advice if Needed

For complex lease renewal situations or if tenants have specific legal concerns, seeking legal advice is a prudent step. Legal professionals can provide guidance on lease terms, rights, and responsibilities, ensuring that tenants make informed decisions and protect their interests.

8. Exploring Alternative Housing Options

Lease renewal decisions may also involve exploring alternative housing options. Tenants may decide to move to a different rental property that better suits their needs or offers more favorable terms. Exploring alternatives is a valid part of the decision-making process.

9. Communicating Intentions Promptly

Regardless of the chosen lease renewal option, prompt communication with the landlord is crucial. Tenants should express their intentions

Mastering Credit Checks: A Tenant’s Guide to Approval

Mastering Credit Checks: A Tenant’s Guide to Approval

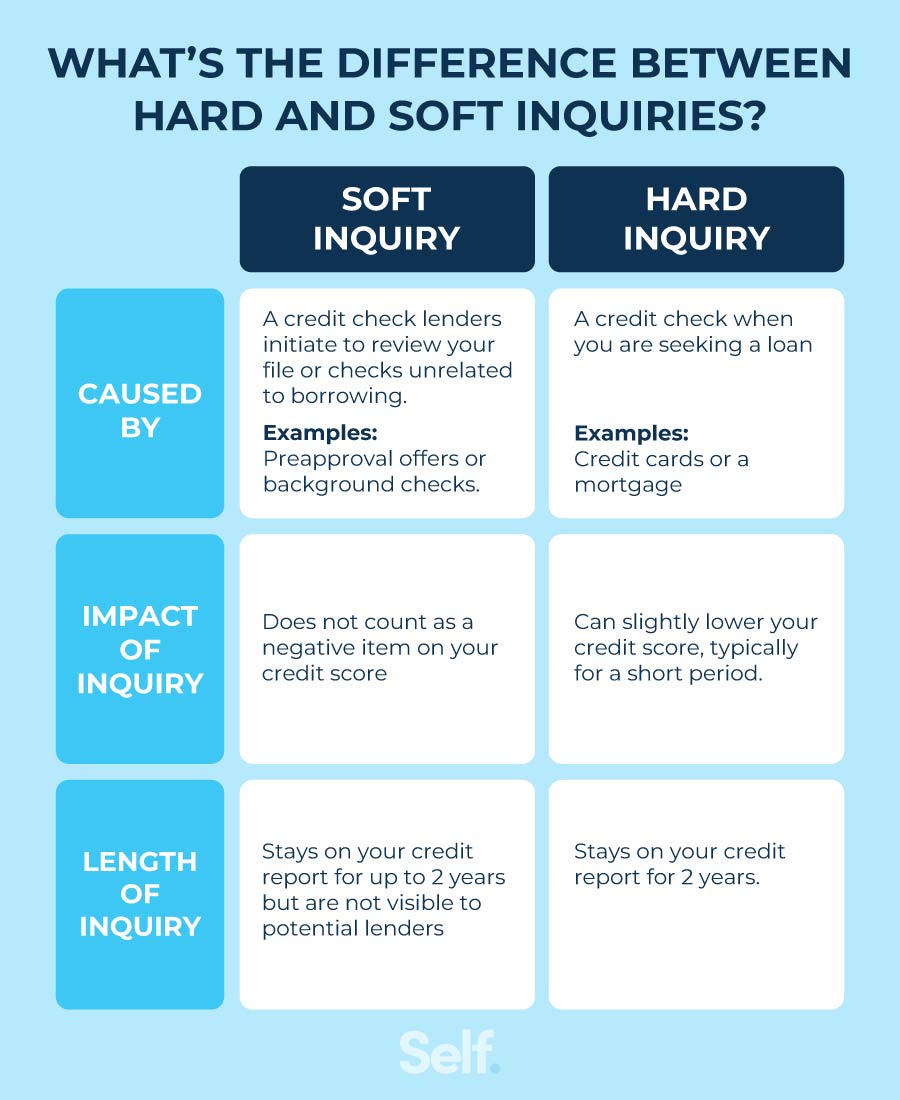

Credit checks are a standard part of the rental application process, influencing a landlord’s decision to approve or deny a tenant. As a prospective tenant, understanding how credit checks work and how to present a favorable credit history is crucial for securing the rental you desire. In this guide, we’ll explore the key aspects of credit checks and offer insights on navigating this integral step in the rental application process.

Understanding the Importance of Credit Checks

Landlords utilize credit checks as a means to assess a tenant’s financial responsibility and reliability. A positive credit history suggests that a tenant is likely to pay rent on time and fulfill lease obligations. Conversely, a poor credit history may raise concerns for landlords, potentially impacting the approval of a rental application.

Credit Checks Link: Credit checks

Checking Your Own Credit Report

Before applying for a rental, it’s advisable to check your own credit report. This allows you to identify any inaccuracies or negative items that may affect your credit score. If discrepancies exist, addressing them beforehand can improve your credit profile and increase your chances of a successful rental application.

Understanding Credit Scores and Ranges

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Landlords often have specific score thresholds for rental approval. Understanding credit score ranges and where you stand within them provides insight into how your credit may be perceived during the application process.

Presenting a Positive Rental History

In addition to credit scores, landlords may assess your rental history. A positive rental history, with no previous evictions and timely rent payments, can compensate for a lower credit score. Providing references from previous landlords attesting to your reliability as a tenant can strengthen your application.

Offering a Co-Signer or Rental Guarantor

If your credit history is less than ideal, offering a co-signer or rental guarantor can enhance your application. A co-signer, typically a financially stable individual, agrees to assume responsibility for rent payments if you default. This added layer of security can alleviate concerns for landlords and increase your chances of approval.

Discussing Credit Concerns with Landlords

Transparent communication is key when credit concerns exist. Before landlords run a credit check, discuss any potential issues and explain any mitigating circumstances. Being upfront about past financial challenges demonstrates responsibility and may create understanding from landlords.

Improving Your Credit Score

If time allows, take proactive steps to improve your credit score before applying for a rental. Paying bills on time, reducing outstanding debts, and addressing any collections or judgments can positively impact your creditworthiness. Demonstrating efforts to improve your financial standing reflects responsibility to potential landlords.

Exploring Rentals with Flexible Credit Requirements

Not all landlords have strict credit score criteria. Some may be open to tenants with lower credit scores, especially if other aspects of the application, such as income and rental history, are favorable. Exploring rental options that align with your financial profile can increase your chances of approval.