Affordable insurance options

Guarding Your Home: Essentials of Rental Insurance

Guarding Your Home: Essentials of Rental Insurance

Securing a rental property goes beyond signing a lease; it involves safeguarding your home and belongings. Rental insurance plays a crucial role in providing financial protection and peace of mind for tenants. In this article, we delve into the essentials of rental insurance, highlighting its importance, coverage aspects, and considerations for tenants looking to ensure their rented space.

Understanding Rental Insurance: A Shield for Tenants

Rental insurance, often known as renters’ insurance, is a type of policy designed to protect tenants and their personal property. Unlike a landlord’s insurance, which typically covers the structure of the building, rental insurance focuses on the tenant’s belongings and liability within the rented space. It serves as a shield against unforeseen events that could lead to financial loss.

Coverage Components: Protecting Belongings and Liability

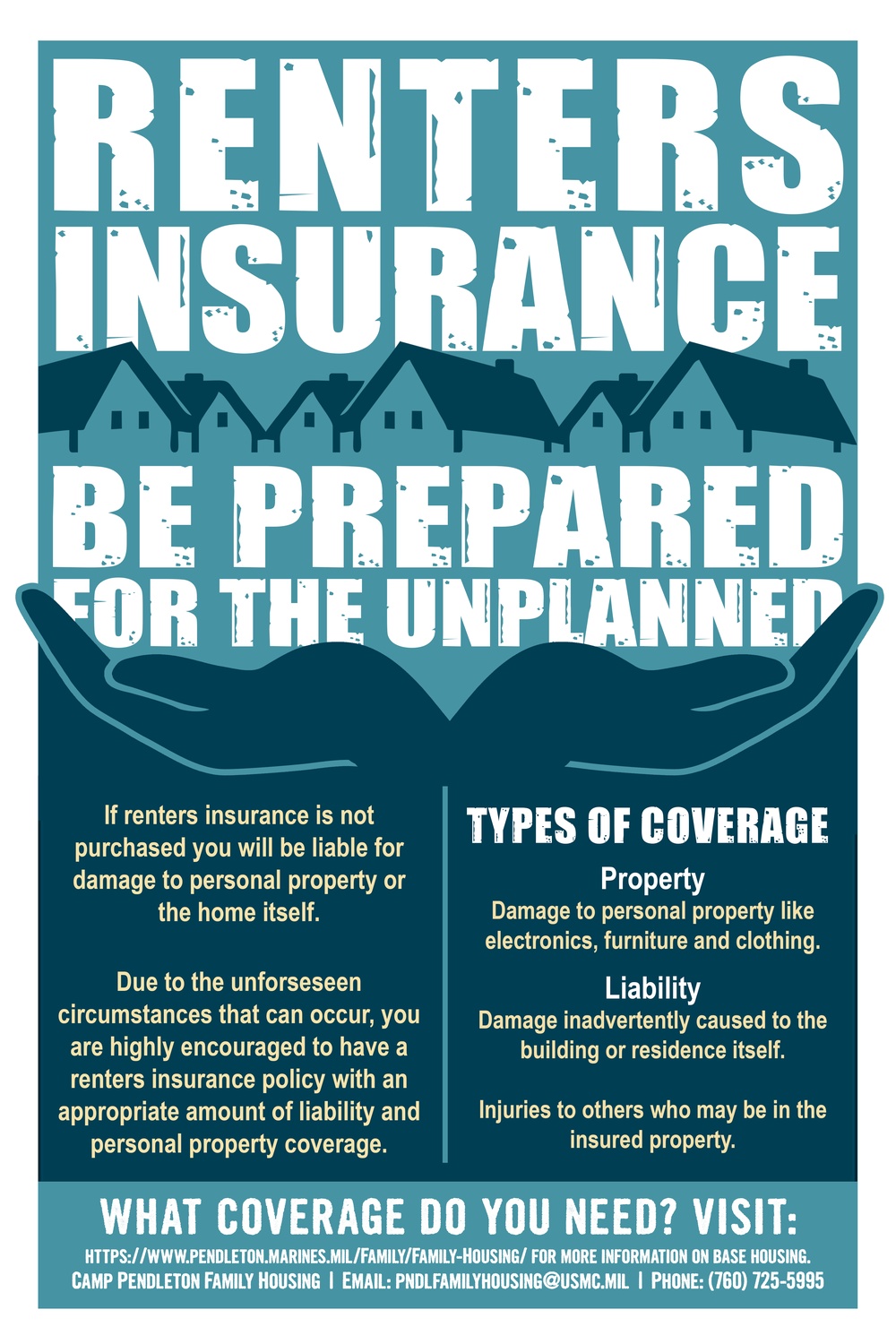

One of the primary components of rental insurance is the protection it offers for personal belongings. In the event of covered perils such as fire, theft, or vandalism, rental insurance helps replace or repair damaged or stolen items. Additionally, rental insurance provides liability coverage, protecting tenants if they are found responsible for damage to the property or if someone is injured while on the premises.

Importance of Rental Insurance: Beyond Landlord Coverage

While landlords typically have insurance for the structure of the building, their policy doesn’t extend to tenants’ personal belongings. Rental insurance fills this gap, ensuring that tenants have financial protection for their possessions. It’s a crucial aspect of responsible tenancy, providing a safety net in the face of unexpected events.

Affordability and Accessibility: Cost-Effective Protection

One misconception about rental insurance is that it is expensive. In reality, rental insurance is often affordable, with policies tailored to meet the specific needs of tenants. The cost is influenced by factors such as the coverage amount, deductible chosen, and the tenant’s location. Considering the potential financial losses it guards against, rental insurance is a cost-effective investment for tenants.

Common Covered Perils: What Rental Insurance Protects Against

Rental insurance typically covers a range of common perils that tenants may face. These include fire, smoke damage, vandalism, theft, water damage (excluding floods), and liability for injuries or property damage caused by the tenant. Understanding the covered perils is essential for tenants to grasp the extent of their protection.

Considerations for Coverage: Assessing Individual Needs

When obtaining rental insurance, tenants should carefully assess their individual needs. Consider the value of personal belongings, including furniture, electronics, clothing, and other items. Additionally, tenants should evaluate the potential liability risks they may face. Tailoring the coverage to individual circumstances ensures that tenants have adequate protection in place.

Mitigating Liability Risks: A Comprehensive Approach

Liability coverage in rental insurance extends beyond damage to the rented property. It also includes protection against lawsuits for bodily injury or property damage caused by the tenant or their guests. This comprehensive approach to liability coverage is crucial for tenants, providing financial support in the event of unexpected accidents or incidents.

Landlord Requirements and Recommendations: Clarifying

Securing Your Space: The Essentials of Renter’s Insurance

:max_bytes(150000):strip_icc()/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

Securing Your Space: The Essentials of Renter’s Insurance

Renter’s insurance is a vital component of responsible tenancy, offering protection and peace of mind for both tenants and landlords. In this comprehensive guide, we’ll delve into the importance of renter’s insurance, its key components, and why every tenant should consider securing their space with this essential coverage.

Renter’s Insurance Link: Renter’s insurance

Understanding Renter’s Insurance Coverage

Renter’s insurance provides coverage for a tenant’s personal belongings within a rental property. It typically includes protection against risks such as fire, theft, vandalism, and certain natural disasters. Understanding the coverage details is crucial for tenants to ensure they have adequate protection for their possessions.

Safeguarding Personal Belongings

One of the primary benefits of renter’s insurance is the safeguarding of personal belongings. In the event of covered perils, such as a fire or burglary, the insurance policy helps tenants recover the cost of damaged or stolen items. This aspect is especially important for valuable possessions like electronics, furniture, and personal items.

Liability Protection for Tenants

Renter’s insurance goes beyond protecting belongings; it also provides liability coverage for tenants. If a guest is injured within the rental property, the liability coverage helps cover medical expenses or legal fees that may arise from a potential lawsuit. This protection is a crucial aspect of responsible tenancy.

Coverage for Additional Living Expenses

In situations where a rental becomes temporarily uninhabitable due to a covered peril, renter’s insurance often includes coverage for additional living expenses. This can include costs associated with temporary accommodation, meals, and other necessities, offering financial support during challenging times.

Mitigating Landlord-Tenant Disputes

Renter’s insurance can play a role in mitigating disputes between landlords and tenants. In the event of damage to the property, having insurance coverage helps tenants address the costs of repairs, reducing potential conflicts with landlords. It promotes a smoother resolution process for unexpected incidents.

Affordability and Cost-Effective Protection

One common misconception about renter’s insurance is that it is expensive. In reality, renter’s insurance is often quite affordable, making it a cost-effective way for tenants to protect their belongings and finances. The peace of mind it provides far outweighs the relatively low monthly or annual premiums.

Customizing Coverage to Suit Needs

Renter’s insurance policies are flexible and can be customized to suit individual needs. Tenants can choose the level of coverage that aligns with the value of their possessions and the potential risks in their area. This customization ensures that tenants pay for the coverage that matters most to them.

Educating Tenants on the Importance

Landlords can play a role in promoting the importance of renter’s insurance to their tenants. Including information about renter’s insurance in the lease agreement or providing educational materials helps tenants understand the benefits and encourages them to secure the coverage. Informed tenants contribute to a more responsible and secure rental community.

Meeting Lease Requirements

In some cases, landlords may require tenants to have renter’s insurance as a condition of the lease agreement. This requirement is not only for the