Maximizing Value: Strategies for Effective Rental Property Valuation

Unlocking the Essence of Rental Property Valuation

Table of Contents

ToggleEffective rental property valuation is pivotal for property owners and investors seeking to maximize returns and make informed decisions. In the dynamic real estate landscape, understanding the strategies and intricacies of valuation is essential.

The Foundation: Understanding Property Value Metrics

Rental property valuation begins with a comprehensive understanding of key metrics. Factors such as location, property size, amenities, and local market conditions significantly influence the property’s value. Analyzing these metrics lays the groundwork for a precise valuation.

Market Trends: Navigating the Dynamic Real Estate Landscape

Staying abreast of current market trends is crucial. A thorough analysis of the local real estate market provides insights into demand, rental rates, and property appreciation. These trends play a pivotal role in determining the competitive value of a rental property.

Comparative Market Analysis (CMA): Leveraging Comparative Data

A Comparative Market Analysis (CMA) is a valuable tool for property valuation. By comparing similar properties in the vicinity, property owners can gauge the competitive market value of their rental property. This data-driven approach enhances accuracy in valuation.

Evaluating Property Income: Beyond the Basics

Rental property valuation isn’t solely about the property itself; it involves evaluating income potential. Property owners must consider current rental income, vacancy rates, and future earning potential. This comprehensive approach provides a holistic view of the property’s financial performance.

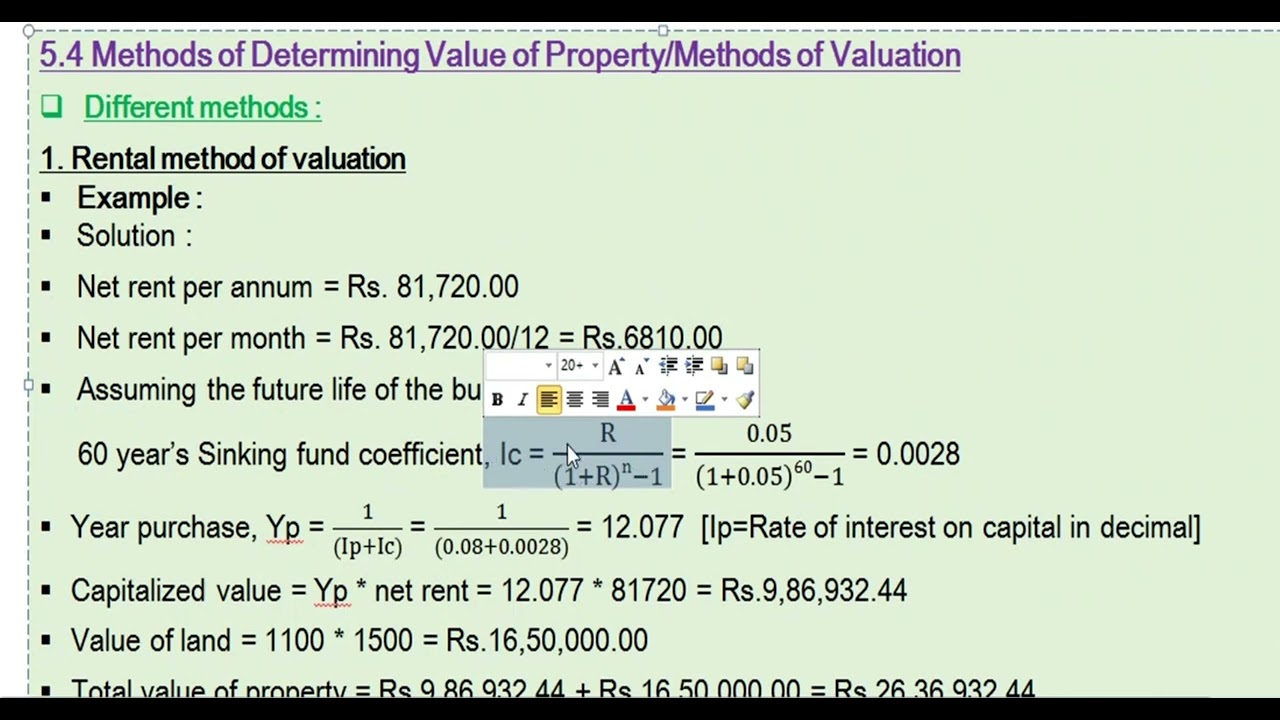

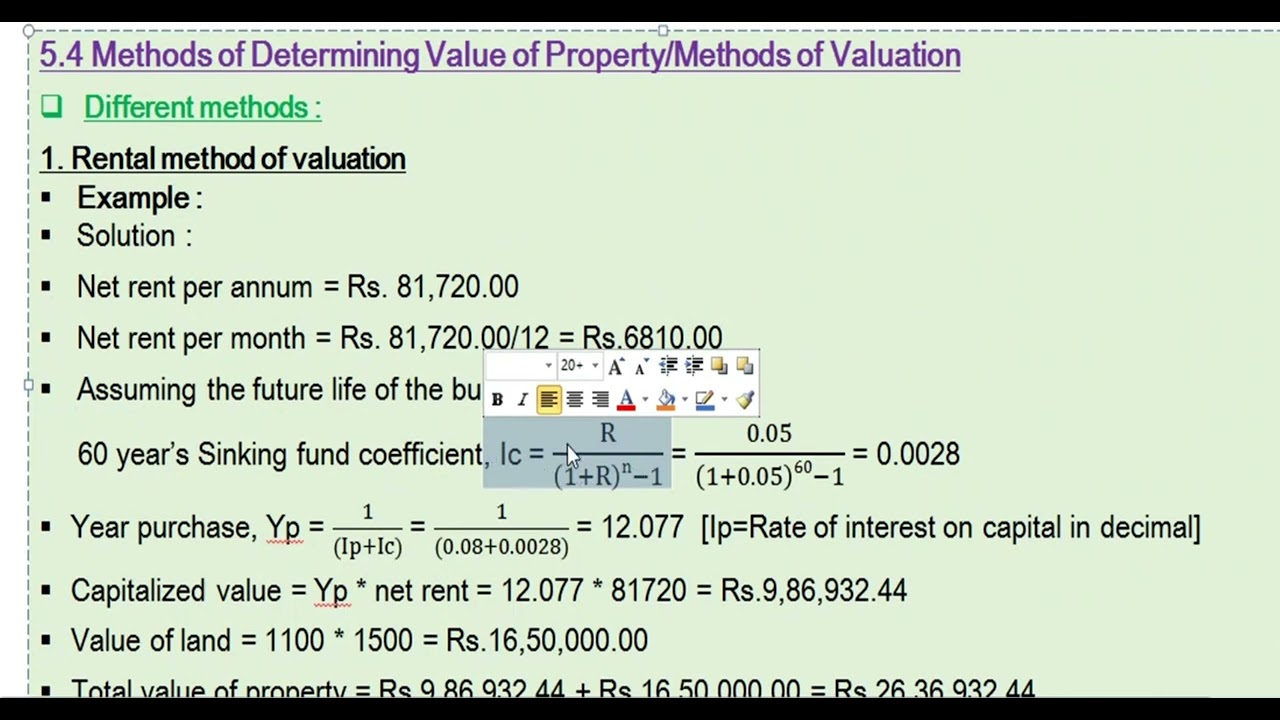

Capitalization Rate (Cap Rate): A Fundamental Valuation Metric

Cap rate is a critical metric in rental property valuation. It represents the property’s expected return on investment and is calculated by dividing the net operating income by the property’s current market value. A higher cap rate signifies a potentially higher return.

Professional Appraisal: Ensuring Precision

For a meticulous valuation, seeking a professional appraisal is advisable. Certified appraisers bring expertise and objectivity to the process, considering various factors that may escape the untrained eye. An appraisal provides a well-documented and defensible property valuation.

Adapting to Economic Changes: A Dynamic Approach

Economic conditions can impact property values. Property owners should remain adaptable and consider the broader economic landscape. Factors like interest rates, employment trends, and economic stability play a role in influencing rental property values.

Strategic Upgrades: Enhancing Property Value

Investing in strategic upgrades can significantly impact a property’s value. Renovations, energy-efficient features, and modern amenities not only attract quality tenants but also contribute to an increase in the overall value of the rental property.

Holistic Management: Sustaining Property Value Over Time

Sustaining property value is an ongoing process. Proactive management, regular maintenance, and staying attuned to market changes contribute to the long-term appreciation of a rental property. A holistic approach ensures continued success in property valuation.

Rental Property Valuation with Walenshipnigltd.com

For personalized guidance and expertise in rental property valuation, Walenshipnigltd.com offers comprehensive services. Their experienced professionals specialize in real estate valuation, providing tailored insights and strategies to maximize the value of your rental property.

In conclusion, rental property valuation is a multifaceted process that demands a strategic and informed approach. By understanding key metrics, staying informed about market trends, utilizing tools like CMA and cap rate, seeking professional appraisals, and adapting to economic changes, property owners can ensure they make well-informed decisions that maximize the value of their rental investments.