February 2024

Lease Transfer: Seamless Handover for Tenants and Landlords

Navigating Smooth Transitions: The Dynamics of Lease Transfer

Lease transfer is a process that involves the seamless handover of a lease agreement from one tenant to another. This intricate process requires careful consideration from both tenants and landlords to ensure a smooth transition and uphold the integrity of the rental arrangement.

Understanding Lease Transfer Dynamics

The lease transfer process is initiated when a tenant wishes to transfer their lease obligations to another party. This can occur for various reasons, such as job relocations, changes in living arrangements, or other personal circumstances. Understanding the dynamics of lease transfer is crucial for all involved parties.

Tenant’s Perspective: When and How to Initiate a Transfer

Tenants considering a lease transfer should carefully review their lease agreement to understand the conditions under which a transfer is permissible. Typically, tenants need to seek approval from the landlord and adhere to specific procedures outlined in the lease. Initiating the transfer process well in advance and communicating openly with both the landlord and potential new tenant are key steps.

Landlord’s Role in the Transfer Process

Landlords play a pivotal role in the lease transfer process. They have the authority to approve or deny the transfer request based on various factors, including the financial stability and suitability of the prospective tenant. It is in the landlord’s interest to ensure that the new tenant meets the same criteria as the outgoing tenant, maintaining the overall stability of the property.

Navigating the Application Process for New Tenants

Prospective tenants looking to take over an existing lease must undergo a thorough application process. This typically involves submitting rental applications, providing references, and undergoing background checks. The landlord evaluates the new tenant’s suitability to uphold the terms of the existing lease, ensuring a seamless transition.

Transfer Considerations: Rent, Deposits, and Lease Terms

During a lease transfer, careful consideration must be given to financial aspects, including rent, security deposits, and lease terms. The incoming tenant assumes responsibility for fulfilling the remaining lease duration and abiding by the original terms. Clear communication and documentation are vital to ensure a mutual understanding among all parties involved.

Addressing Potential Challenges and Concerns

Lease transfers may encounter challenges, such as disagreements between tenants and landlords or unforeseen complications in the application process. Open communication is crucial to address concerns promptly and find amicable solutions. This proactive approach helps prevent misunderstandings and fosters positive relationships among all parties.

Legal Aspects of Lease Transfer

From a legal standpoint, lease transfers should adhere to local tenancy laws and regulations. Both tenants and landlords should be aware of their rights and obligations throughout the transfer process. Seeking legal advice or involving legal professionals can provide added assurance that the transfer aligns with legal standards.

Documenting the Transfer: Importance of Written Agreements

Once all parties are in agreement, it is essential to document the lease transfer through written agreements. These agreements outline the responsibilities of both the outgoing and incoming tenants, as well as any conditions set by the landlord. A well-drafted

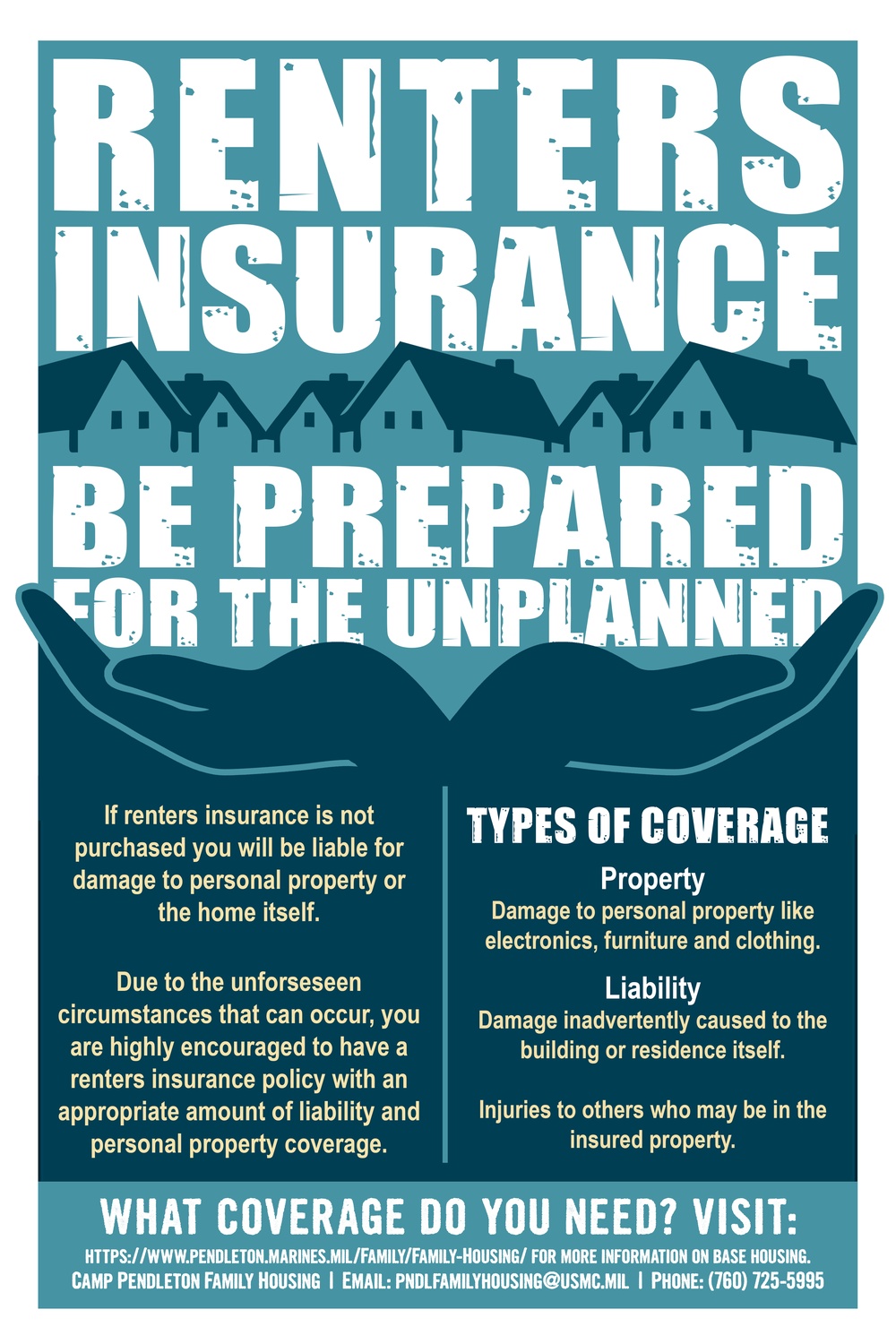

Guarding Your Home: Essentials of Rental Insurance

Guarding Your Home: Essentials of Rental Insurance

Securing a rental property goes beyond signing a lease; it involves safeguarding your home and belongings. Rental insurance plays a crucial role in providing financial protection and peace of mind for tenants. In this article, we delve into the essentials of rental insurance, highlighting its importance, coverage aspects, and considerations for tenants looking to ensure their rented space.

Understanding Rental Insurance: A Shield for Tenants

Rental insurance, often known as renters’ insurance, is a type of policy designed to protect tenants and their personal property. Unlike a landlord’s insurance, which typically covers the structure of the building, rental insurance focuses on the tenant’s belongings and liability within the rented space. It serves as a shield against unforeseen events that could lead to financial loss.

Coverage Components: Protecting Belongings and Liability

One of the primary components of rental insurance is the protection it offers for personal belongings. In the event of covered perils such as fire, theft, or vandalism, rental insurance helps replace or repair damaged or stolen items. Additionally, rental insurance provides liability coverage, protecting tenants if they are found responsible for damage to the property or if someone is injured while on the premises.

Importance of Rental Insurance: Beyond Landlord Coverage

While landlords typically have insurance for the structure of the building, their policy doesn’t extend to tenants’ personal belongings. Rental insurance fills this gap, ensuring that tenants have financial protection for their possessions. It’s a crucial aspect of responsible tenancy, providing a safety net in the face of unexpected events.

Affordability and Accessibility: Cost-Effective Protection

One misconception about rental insurance is that it is expensive. In reality, rental insurance is often affordable, with policies tailored to meet the specific needs of tenants. The cost is influenced by factors such as the coverage amount, deductible chosen, and the tenant’s location. Considering the potential financial losses it guards against, rental insurance is a cost-effective investment for tenants.

Common Covered Perils: What Rental Insurance Protects Against

Rental insurance typically covers a range of common perils that tenants may face. These include fire, smoke damage, vandalism, theft, water damage (excluding floods), and liability for injuries or property damage caused by the tenant. Understanding the covered perils is essential for tenants to grasp the extent of their protection.

Considerations for Coverage: Assessing Individual Needs

When obtaining rental insurance, tenants should carefully assess their individual needs. Consider the value of personal belongings, including furniture, electronics, clothing, and other items. Additionally, tenants should evaluate the potential liability risks they may face. Tailoring the coverage to individual circumstances ensures that tenants have adequate protection in place.

Mitigating Liability Risks: A Comprehensive Approach

Liability coverage in rental insurance extends beyond damage to the rented property. It also includes protection against lawsuits for bodily injury or property damage caused by the tenant or their guests. This comprehensive approach to liability coverage is crucial for tenants, providing financial support in the event of unexpected accidents or incidents.

Landlord Requirements and Recommendations: Clarifying

Maximizing Rental Property Value: Strategies for Appreciation

Strategies for Maximizing Rental Property Value

Rental property appreciation is a key factor in building long-term wealth and success in real estate investment. In this guide, we’ll explore effective strategies for property owners to maximize the value of their rental investments, ensuring sustained growth and profitability.

Investing in Location: The Foundation of Appreciation

The location of a rental property is a critical determinant of its appreciation potential. Properties in desirable neighborhoods with access to amenities, good schools, and convenient transportation tend to appreciate more rapidly. Investing in prime locations sets the foundation for long-term value growth.

Regular Maintenance and Upgrades: Enhancing Property Appeal

Maintaining the property in good condition is essential for appreciation. Regular maintenance, timely repairs, and strategic upgrades not only attract quality tenants but also contribute to the property’s overall appeal. A well-maintained property is more likely to experience steady appreciation over time.

Adapting to Market Trends: Staying Ahead of the Curve

Real estate markets are dynamic, and understanding market trends is crucial for maximizing property appreciation. Stay informed about changes in demand, emerging neighborhoods, and shifts in tenant preferences. Adapting your property to align with these trends positions it for continued growth in value.

Smart Renovations for Value Enhancement

Strategic renovations can significantly enhance the value of a rental property. Focus on improvements that provide a good return on investment, such as kitchen upgrades, bathroom renovations, or energy-efficient enhancements. Thoughtful renovations not only attract higher-paying tenants but also contribute to long-term appreciation.

Effective Property Management: Minimizing Vacancies and Maximizing Returns

Efficient property management is key to ensuring a consistent stream of rental income and preventing unnecessary vacancies. Proactive management, responsive communication, and addressing tenant concerns promptly contribute to tenant satisfaction and long-term occupancy, positively impacting property appreciation.

Diversification and Portfolio Management: Spreading Risk for Long-Term Growth

Diversifying your real estate portfolio can be a strategic move for maximizing overall appreciation. Owning properties in different locations or with diverse rental demographics helps spread risk and increases potential returns. A well-balanced portfolio is more resilient to market fluctuations.

Staying Tax-Efficient: Leveraging Incentives and Deductions

Understanding tax incentives and deductions related to real estate investments is crucial for maximizing property value. Interest on mortgages, property management fees, and depreciation are among the expenses that may qualify for tax benefits. Leveraging these incentives contributes to a more tax-efficient investment.

Utilizing Technology for Marketing and Management

Incorporating technology into your property management and marketing efforts can enhance efficiency and tenant attraction. Online platforms, social media, and property management software can streamline operations, improve visibility, and contribute to the overall desirability of the property, positively impacting appreciation.

Investing in Sustainable Practices: Enhancing Long-Term Value

Consider incorporating sustainable practices into your property management. Energy-efficient appliances, eco-friendly landscaping, and green initiatives not only attract environmentally conscious tenants but also contribute to long-term value enhancement. Sustainable features are increasingly valued in the real estate market.

Monitoring and Adapting: A Continuous Improvement Approach

Property appreciation requires a continuous improvement mindset. Regularly monitor market conditions, property performance, and